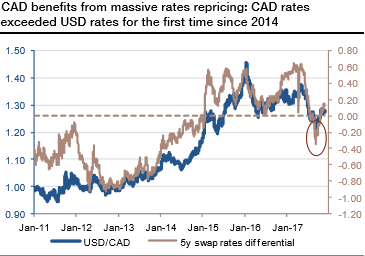

The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer above 1st graph), and our USD rates projections can realistically drag the USDCAD to 1.20.

The outperformance of NAFTA-linked vol: Though not explicitly an Outlook 2018theme, we had flagged the attractiveness of owning CAD-denominated correlations, specifically CADUSD vs CADJPY as a positive carry NAFTA hedge in December.

CAD and MXN have already proven relative outperformers since then amid the broad based softness in vols elsewhere (refer above chart), which allied with the collapse in USDJPY vol has helped this trade: realized CADUSD – CADJPY corrs have clocked almost 20 points over implieds since publication, and there is value still to be extracted from CADJPY vs USDJPY vol spreads–the parsimonious, transaction cost friendly implementation of the correlation pair above – that trades near 3-yr lows in implieds and presents ~2vol pts of implied –realized vol edge (refer above chart).

Trade tensions as a potential vol generator is a theme worth pursuing in 2018 since there are reasonable odds of the Trump administration re-focussing attention on this ideologically convicted issue with tax reform now out of the way. NAFTA negotiations are a high profile platform to stamp a different American approach to international commerce, and risks of unilateral US withdrawal from the treaty are non-negligible.

The run-up to the next round of discussions in late January, therefore, bears close watching and positioning for via carry friendly vol spreads if markets permit. For now, CAD rather than MXN is the better value play on these risks, but the latter is a more potent, higher beta expression of the theme and a pullback in vols and riskies there in coming weeks will be an opportunity to install fresh longs.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis