The repricing of monetary policy in the past week has been as dramatic for FX as it has been for rates, with some of the largest weekly moves in the past year in numerous currency pairs.

These FX moves have been commensurate with the relative re-pricing of monetary policy. Even the sharp renewed decline in the broad dollar is well explained by the fact that the US largely sat out of the rates repricing phenomenon that took hold of large parts of the rest of the G10 universe.

The end result is a substantial reorganization of the policy normalization pecking order where the USD has gone from the front of the pack in terms of priced hikes by end-2018, to the middle, and CAD has leapt to the top of the heap with more than 50bp hikes priced (BoC is scheduled for monetary policy today).

This week we survey the policy repricing and FX moves across G10 and assess how much of the policy repricing has been appropriate, where it’s perhaps gone too far versus what still needs to catch up.

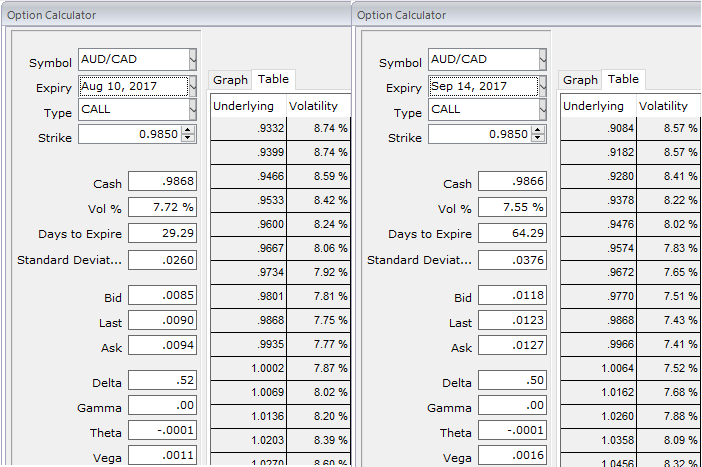

Please be noted that the implied volatilities of AUDCAD have been extremely lackluster, crawling at shy above 7.7% for 1m tenor and 7.55% for 2m tenor despite the significant data announcements as stated above.

AUDCAD 6M vols appear decent buys given their depressed levels (not far from 2014 lows) and the uberflatnessof the 3M-6M vol curve.

Realized vols are not stellar however in a dollar-centric environment; hence theta bleed on vol longs is best avoided via forward volatility (FVA) structures.

So, opening positions in OTM AUD puts/CAD calls to monetize a potential correction lower in the cross is the clean directional play; one can for instance consider buying 6M 0.91 AUD puts/CAD calls with leverage in excess of 5:1 as a medium-term bearish play, where the admittedly distant barrier (8% OTMS) is still within the realm of possibility, having been breached only last September after the CNY devaluation.

Alternatively, relative value constructs involving buying AUD puts/CAD calls vs. selling USD puts/CAD calls(live, no delta-hedge) appeal as low-cost ways of assuming exposure to the same directional dynamic.

OTM AUD puts/CAD calls are historically cheap and discounted in vol (and premium for the same delta) relative to OTM USD puts/CAD calls, which is odd because their spread behaves like an anti-risk asset by virtue of effectively being short AUDUSD delta, and hence ought to command a net positive premium.

Cumulative P/Ls from owning 6M 25D AUD put/CAD call – 6M 25D USD put/CAD call option spreads (bp CAD), and 6M 25D AUD puts/USD calls.

All options live (not delta-hedged) and rolled into fresh strikes monthly. Shaded bars represent vol spike episodes. No transaction costs.

The anti-risk nature of the AUDCAD – USDCAD option spread: it essentially mimics returns from an equivalent tenor/delta AUD put/USD call – but at a fraction of the cost of the latter and with outperformance in periods of calm when time decay is a drag on the latter.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?