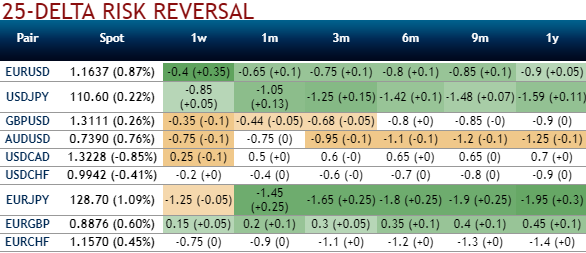

Before we move onto strategies, let’s just glance through the risk reversals of USDCAD for short-term tenors are showing minor changes (changes only in 1w expiries), while bullish hedging bids remain intact for the long-term. While the IV skews are also positive for 1w tenor is slightly stretched out for OTM puts, while the 3m IVs are still positively skewed which means bullish risks remain intact despite the above stated fundamental factors.

While 1w forward rates show negligible changes and bearish targets in the longer tenors.

Accordingly, we uphold staying short USDCAD through a low-cost RKO: The USDCAD put RKO was originally conceived as a low-cost option to gain exposure to what seemed like a decent chance of a near-term breakthrough in NAFTA negotiations.

Now what seems most likely is that the option will expire worthless, particularly after the latest developments in the US Trade policy which seemingly swung the tone of NAFTA negotiations back to an antagonistic one where Trump has once again publically hinted about the possibility of pulling out.

Hence, we advocate staying short in 1w USDCAD forwards with a view to arresting potential bearish risks in the near-term and longs in 3m forwards.

Alternatively, Buy 2m 1.29 USDCAD put, RKO 1.25 for 14bp, spot reference: 1.3183.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 172 levels (which is bullish), while hourly USD spot index was at -5 (neutral) while articulating at (14:16 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate