The Mexican results for Q2 GDP is published today. The Mexican economy shrank 17.3 percent on quarter in the three months to June 2020, following a 1.2 percent contraction in the previous period and compared with market forecasts of a 17.8 percent plunge, a preliminary estimate showed. It was the steepest contraction on record, amid lockdowns restrictions due to the coronavirus pandemic. Industrial activity plunged 23.6 percent, after dropping 1.2 percent in the prior quarter; and the services sector contracted 14.5 percent, faster than a 0.9 percent fall.

Today’s data constitutes merely a backward glance though, which means that only significant deviations are likely to have an effect on the peso. What is more decisive is the outlook and the question of how (quickly) the export orientated country that is closely connected with the US economy, will be able to overcome the crisis. If the prospects for an economic recovery improve (for an instance), as a result of the expansionary monetary and fiscal policy measures – the Mexican economy might also be able to benefit. That would of course support the peso, that has also been able to benefit from the dollar weakness over the past weeks. However, in view of the continued high number of new infections in both countries the pandemic-related uncertainty remains high. The Mexican government has so far provided little support for companies and continued restrictions point towards a slow recovery. This is likely to limit the peso’s potential for a recovery against USD.

OTC Updates and Trading Strategies:

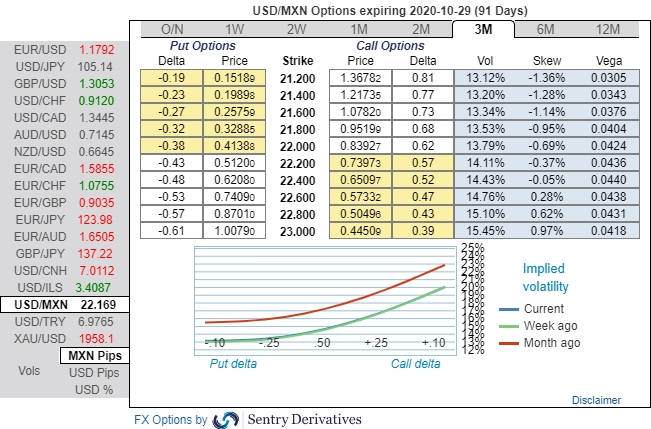

As stated in our previous posts, the positively skewed IVs of USDMXN of 3m tenors have delivered as expected and have still been indicating upside risks (bids for OTM strikes up to 23 levels), while IV remains on higher side and it is perceived to be conducive for options holders.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

We consider 3M USDMXN debit call spreads 21.46/23.50 (spot reference: 22.168 levels).

Sold EUR vs MXN in cash at 27 levels. Marked at 2.04%. Courtesy: Sentry & Commerzbank

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate