EURAUD has lost about nine figures since the start of the year on the back of political fears pressuring the EUR and the risk-friendly mood supporting the AUD via metals. But the pair is now testing the 1.37 support.

A continuation of the decline would require a break of this support, which would involve rapid decisive moves such as EURUSD breaking below 1.05 and/or AUDUSD breaking above 0.77. On the other side, it is believed that the November lows of 1.4040 should cap upside.

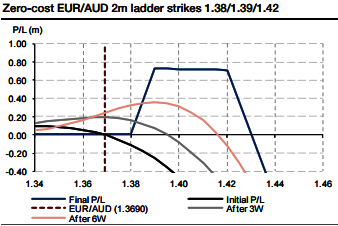

There is a high probability that EURAUD can mean revert higher in the near term and a low probability that it can fall significantly. Both developments can be attractively traded via options. We structure a zero-cost structure to trade the scenario of a likely bounce of limited amplitude.

Buy zero-cost ladder call, the trade is not directly exposed to the French election outcome: the 2m expiry expires in April, and being long euro is not exposed to Le Pen risk.

Selling the vol risk premium conditionally: The volatility risk premium on the front end of EUR vol curves is now pretty elevated. ATM implied vols are high compared to realized vols, even in pre-election tenors.

In the case of EURAUD, the 2m implied is trading 2.2 vols above the current realized (refer above graph). Market vol is clearly expensive due to political risk, as the realized vol is reaching its lowest level since start-2016.

Importantly, that risk is essentially pricing the bearish case, as it is linked to the possibility of volatile euro fall.

So, we like being short vol and selling that premium conditionally on a pay-off benefiting from a higher spot.

Prefer a ladder to a call spread ratio As we expect limited spot appreciation and topside volatility, we recommend buying a 2m call ladder (refer above graph). That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level (in our pay-off, between the 1.39 and 1.42 strikes in 2m).

However, the risk is potentially unlimited above 1.43, and investors would have to delta-hedge dynamically the trade in the event of fast upside.

Buy-and-hold structure and Greeks’ behavior: The above profile sells convexity. Being short gamma implies a buy-and-hold profile, as the full leverage can only be monetized at the expiry.

However, the trade benefits from the positive time value, such that the topside breakeven in terms of mark to market goes farther on the right with time (curves on above graph).

Namely, the structure has a positive market value up to 1.3950 in three weeks and up to 1.4150 in six weeks.

Finally, the short vega profile fits with the idea that a higher EURAUD should mean lower implied vol, consistent with the negative skew. Front-end risk reversals turned negative with the French election risk due to the stress in EURUSD skew (EURAUD has usually a positive skew).

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios