The political uncertainty is dominant in the euro area, ECB President Mario Draghi said in an interview with El Pais published last week. “So far we’ve seen that in the short-term the response to these uncertainties has been more muted than people expected.”

While the ECB may be on top of any initial turmoil, it can do less about the hit to longer-term growth expectations that political paralysis in Italy may bring. The economy there has barely grown since entering the euro, and output per head is below the level before the single currency was introduced. The Italian statistics agency Istat forecast in November an expansion of 0.8 pct in 2016 and 0.9 pct next year.

If Italy’s growth is hobbled further, that bodes ill for the ECB’s own outlook for the euro area. Fresh forecasts are due to be presented at the policy meeting that culminates on Dec. 8, and which will serve as the basis for the decision on QE.

The referendum also has the prospect to deepen the crisis in Italy’s banking sector, which under the weight of around 360 billion euros in non-performing loans and weak profitability has seen an investor sell-off this year. That outcome also falls at the ECB’s door, as the central bank is responsible for euro-area banking supervision, and, if needed, triggering resolution proceedings.

OTC updates:

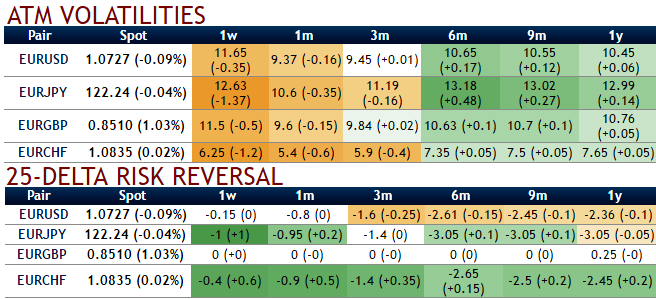

Delta risk reversals of euro crosses: From the nutshell showing delta risk reversals, you can probably make out that the euro has been resilient

The pairs (EURJPY, EURUSD) have been one of the most expensive pairs to be hedged for downside risks as it indicates puts have been relatively costlier over calls, while EURCHF and EURGBP have been neutral bet but changing hedging sentiments from extremely bearish to slightly positive.

Needless to specify, euro vols have been turbulent but this time these IVs are not only owing to ECB’s monetary policy decision but other geopolitical news, such as election season in the euro area.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on the long-term downtrend that has lasted since mid-December 2014 in the case of EURJPY and as a result delta risk reversal for EURJPY was turning into negative.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons