As we do not expect the USDJPY to exceed 126 (multiyear double top since 2002), we prefer for a call spread ratio 1x1.5 instead of vanilla structures, such that the topside breakeven is at this level. Shorting volatility means negative convexity, and investors would thus suffer in terms of mark-to-market if USDJPY gains were to accelerate early.

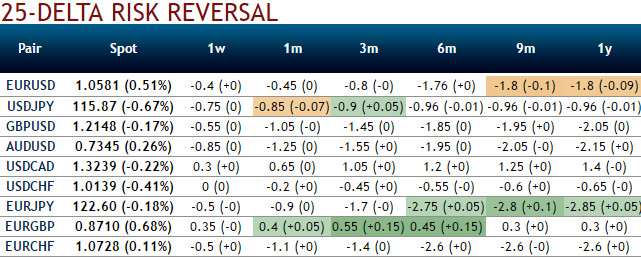

While you could see positive hedging bids for USDJPY in 3m risk reversals and 2m IV skews are evidencing mounting hedging interests for downside risks (while articulating). Hence, even the underlying pair keeps dragging it drags maximum up to above stated levels within a span of 3m tenors.

As a result, on hedging grounds, we advocate buying USDJPY 6m call spread 1x1.5 strikes 118/120.5 (at spot ref: 116.324).

Trade risks: USDJPY above 125 in six months. USDJPY acceleration beyond 118 after the first two months would hurt the mark-to-market of the strategy. Investors face unlimited losses if the USDJPY trades above 125 at the 6m expiry.

We mitigate that risk by selecting a 6m expiry, which reduces the negative gamma compared to a shorter expiry and fits the idea of a gradual appreciation. However, lengthening the maturity would not by itself fully prevent the risks inherent to a short gamma profile.

So we pick sufficiently OTM strikes to protect the trade against a two-month move to 118 and a four-month to 122. These breakeven levels increase if the implied volatility falls.

All in all, the trade is profitable if the USDJPY trades between 118 and 125 in six months and will generate a maximal leverage at the 120.5 strike.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close