Macron’s victory has been greeted by markets with a big yawn, which in hindsight should not be too surprising given that it was anticipated. The euro had rallied last week in expectation of a Macron presidency.

Perhaps more interesting was the state election in Schleswig-Holstein, a German locality where Lord Palmerston famously remarked was only understood by three people. One of whom was dead, the other turned mad, and he himself who had forgotten the details. The situation has become a lot less complicated since, and the surprise victory by Merkel’s party was taken as confirmation of its growing momentum ahead of the September Federal election.

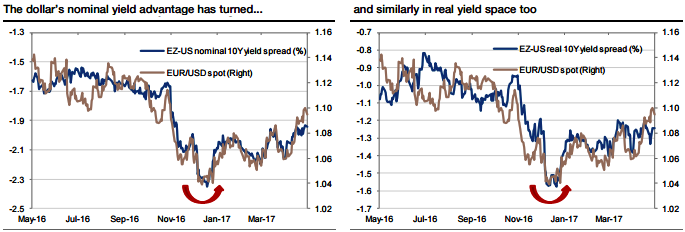

All this points to receding European political risks, and we can focus back on economic and market drivers. The market is almost fully expecting another Fed hike in June, but still somewhat doubtful of the third hike by year-end. We believe that the dollar’s peak against the Western European currencies is now behind us, as the yield divergence driver falters further (refer above charts).

The Euro went up a bit, down a bit and ended pretty much where it was last week. It faces two short-term challenges.

The first is that the FX market has moved a good way further in recent days than the bond market, with the Treasury/Yield spread not very different from where it was when EURUSD was under 1.08. Bunds need to catch up with the currency.

The second hurdle is positioning. CFTC data show the smallest speculative Euro short in 3 years. That’s still a short position, of course, so much more of a short-term hurdle than a reason for a deep correction to lighten positions. A period of choppy trading is likely for now, but we do still expect EURUSD to move higher in due course.

We also still like EURJPY *(more than EURUSD) and EURGBP longs. Finally, against a risk and Europe-friendly backdrop, SEK, HUF, and PLN are all going to attract inflows.

The implied volatilities in OTC markets for euro crosses are the massive collapse, while risk reversals for these pairs are indicating shifting hedging sentiments.

Looking ahead at this week, the market-driving news looks concentrated on the back end of the week. The US has Fed speakers all week (Mester, Bullard today) but the key data comes with CPI and retail sales on Friday. The UK has industrial production, trade and the BOE MPC meeting on Thursday. The Eurozone has industrial production on Friday. Chinese CPI and PPI data are due on Wednesday.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges