The current market condition is not a stable equilibrium -without rate hikes as a circuit breaker, TRY could weaken substantially.

Now that the market has jumped to pricing in significant rate hikes, an under-delivery of rate hikes by CBRT relative to market expectations will most likely precipitate further currency weakness.

We deem the measures the CBRT introduced this week to be insufficient to stabilize the lira in a negative feedback loop scenario taking hold. These measures include allowing exporters to repay export-credit to the CBRT in lira instead of US dollars and releasing $1.4bn of FX liquidity to banks.

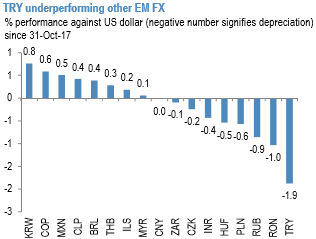

The signal from these measures is not strong enough, in our view, and their scope is too limited to convincingly turn around investor sentiment. The weakness in Turkish assets accelerated over the past week. The lira has weakened by around 2% against the US dollar since the start of November, underperforming other EM currencies (refer above chart). The underperformance has been driven in part by a worse-than-expected CPI inflation.

We believe there is a good case to enter fresh bearish positions in both local bonds and the currency at current levels. We have a preference for entering bearish positions in the currency, as the CBRT is likely to only hike rates in response to currency weakness.

Glimpse through options trades:

EURTRY options are simply turbo-charged versions USDTRY since their near-identical implied vol levels do not adjust for wider forward points in EURTRY on account of negative European yields. Even setting aside high implied yields for a moment, there is a vanilla RV case for preferring to own longer-end TRY options over shorter dated ones predicated on the near-extreme flatness of the option surface across both ATM strikes and risk-reversals (refer above chart), which once again is inconsistent with the prevalence of high interest rates.

The dilemma for investors faced with elevated carry adjusted option prices in EM currencies is whether to play offense or defense – monetize the healthy FX implied yield on offer in limited downside format with options (in this case, purchasing ATMF EUR put/TRY calls or ATMF vs. ATMS EUR put/TRY call spreads), or adopt a more cautious approach of buying ATMF straddles where points carry merely serves to subsidize the cost of owning option protection?

While taking advantage of the same vol surface set-up, the core alpha drivers in the two cases are different: the former seeks to harvest high yields and implicitly relies on the persistence of a positive risk backdrop, while the latter is a defensive posture intended to hedge against an eruption in volatility and hence is currency bearish at heart. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch