Brexit negotiations and central bank policy expectations are likely to heavily influence the pair over the coming months.

Having made ‘sufficient progress’ earlier this month, the focus of negotiations will now move towards trade.

We expect the Bank of England to raise rates in August 2018, since the BoJ succeeded in killing yen volatility, Japanese long-term rates are following US rates, but have shown almost zero volatility for a year now. As long as the Japanese rates market is dormant due to the BoJ commitment to monetary easing, the currency will likely stay driven by the sterling side.

GBPJPY has been edgy at 152.121 levels ever since the occurrence of hanging man pattern candle which is bearish in nature, we anchor the prevailing bearish stance of is backed by both leading oscillators, one can think of shorts in this pair only for the short-term basis. For more readings, refer our technical section.

OTC outlook and Hedging Perspectives (GBPJPY):

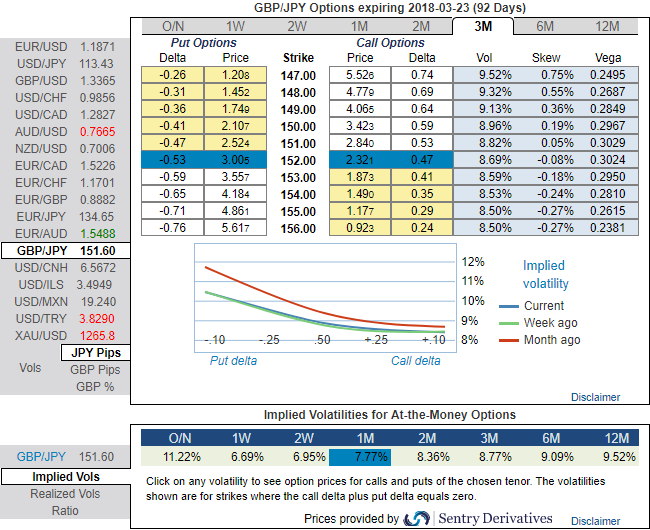

Please be noted that the positively skewed IVs of GBPJPY of 3m tenors signify the hedgers’ interests in OTM put strikes (upto 147 levels) and isn’t this a luring factor for a shrewd bear. While 1w/3m IVs of ATM contracts are trending above 7.7% and 8.7% respectively that are the suitable combinations for diagonal put ratio spreads.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 3m tenor for long leg and improve odds on options below strategy.

With this interpretation, one can judge whether the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building a directional strategies and volatility patterns at the same time.

In order to mitigate downside risks and keep them on the check, we advocate adding longs in 2 lots of ATM -0.49 delta puts of 3m tenor while writing 1 lot of 2% OTM put of 1m tenor.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -66 (which is bearish), while hourly JPY spot index was at -138 (which is bearish) while articulating (at 07:11 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate