Sterling remains close to the bottom end of recent trading ranges as markets wait for today’s update from the BoE and the outcome of PM May’s talks in Brussels. Meanwhile, the US dollar moved higher against the euro yesterday after December data showed ongoing problems in the German industrial sector.

The Bank of England will provide its first policy decision and Inflation Report for the year at midday. That will be followed by BoE Governor Carney’s first press conference of 2019.

After the weaker than expected, UK services PMI reading in the recent past, the GBP and UK yields have been observed under pressure ahead of the BoE. We have no data today, with PM May in Northern Ireland for a second day. Yesterday, she said that while a changed ‘backstop’ was a key issue in the Brexit process, she retains an ‘unshakeable’ commitment to avoiding a hard Irish border. Moreover, while she believes that technology can play a part on the border, it must be workable.

FX market participants with GBP exposure are not very interested in statements about likelihoods. All outcomes are sufficiently likely to require participants to be prepared. The speculative market participants whose portfolios are widely diversified and who therefore can apply probability statements stand to attention ready to bet on the GBP recovery, which can be expected in case of a constructive outcome.

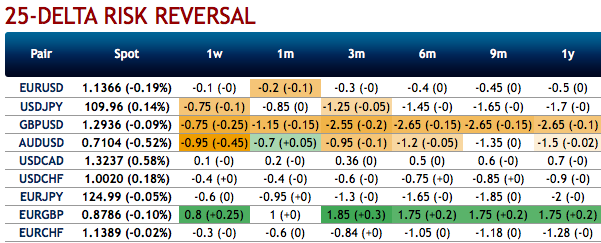

However, that should not prevent the market from reflecting the changing likelihood of “no deal” proportionately in the GBP exchange rates. That does not happen the whole time, and when it does happen it happens in bursts – as was the case yesterday when Sterling eased on the back of not-so-surprising PMI data. Does that mean that the no deal risk is reflected adequately in the GBP exchange rates this morning? Even the asymmetry of the risks is priced into the exchange rates to a very limited extent with 3M 25-delta risk reversals around 1.50 percentage points (given that 3M ATM vol trades around around 10.1%) compared with the market reaction following the Brexit referendum in 2016.

The fresh negative bids in the shorter tenors have been observed to the bearish risk reversal atmosphere in the GBP OTC markets, this is interpreted as the hedgers are keen on bearish risks in the broader perspective.

You could easily make out that the positively skewed IVs of GBP have been stretched out on downside. Mounting bidding for OTM puts is interpreted as the hedgers’ interests for the downside risks (refer above nutshells).

It is tough to believe either that the UK would be suffering any food shortages in case of “no deal” and expect that Brits will still be able to fly to Spain for their vacation trips. Anyone banking on horror scenarios is likely to fall flat on their face.

However, it is likely to be days or weeks between the news that there is going to be a no deal Brexit and the realization that even in that case Great Britain is not going to be swallowed up by the ground. Quite a few analysts consider the GBP weakness during this time frame to be sufficiently priced in. Courtesy: Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly GBP is at -48 (bearish), hourly USD spot index is inching towards 117 levels (bullish), while articulating at 10:44 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness