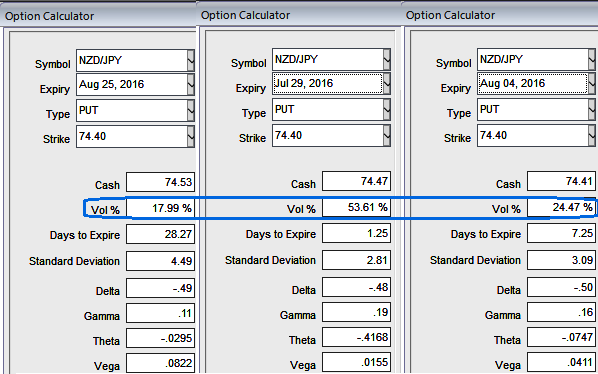

The implied volatilities of ATM contracts for near month expiries of this the pair are spiking in sky-rocketed pace. Here are the evidences:

ATM IVs of this pair is trending higher at around 53.61%, 17.99% and 24.47% for 1D, 1M and 1W expiries respectively which is the highest among G20 currency space. While current IVs of ATM contracts are at highest levels which seem quite absurd but likely to perceive hover around at an average 18% in the long run that would divulge pair’s gain contemplating risk reversal arrangements.

We give the absolute credits of the rising IVs to monetary policy season, as Yen remains fairly well bid against Kiwi despite the BoJ’s upbeat assessment of the Japan economy and deflationary pressures from decades together.

This week is a busy one for Japan data watchers with many June releases including CPI, housing starts, and FX markets digesting the better than forecasted trade balance data, while the key focus should be on Friday’s BoJ policy meeting.

With a clear slowing in the inflation trend and inflation expectations among both corporates and households, and Brexit, we find it hard to imagine whether the BoJ would ease this week or not, given its frequent statement “the central bank would observe risks to economic activity and prices, and take easing measures in terms of three dimensions—quantity, quality, and the interest rate.

The economy has struggled with deflation for two decades. Even after the BOJ's massive qualitative and quantitative easing (QQE) program and venture into negative interest rates territory, the Asian economy hasn't been able to boost domestic consumption and shake off deflation.

Indeed, according to the Japan Center of Economic Research, 86% of 42 economists surveyed between June 27 and July 4 expect policy easing next week. No action by the BoJ would erode its credibility on achieving the inflation target and tighten monetary conditions through JPY appreciation.

Whereas an OCR cut by RBNZ is all on the table but seems fully priced in for next month as the major contributor of Kiwis growth the GDT price index has shown a remarkable improvement has sent an earlier confirmation of easing bias, but FX markets remain reluctant to get short in Kiwi dollar.

NZDJPY’s rising implied volatility could be used as follows in option strategies:

Trading implied volatility directionally (vega)

Capturing the volatility risk premium in trading the gamma (dynamic delta-hedging)

Trading the volatility market (smile and term structure dynamics) non-directionally.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential