Attempts of bull swings restrained below 7EMA, bearish EMA crossover& Gravestone Doji rightly placed at the resistance of 83.762 or near 61.8% Fibonacci retracements to indicate weakness, consequently, current prices slid below EMAs.

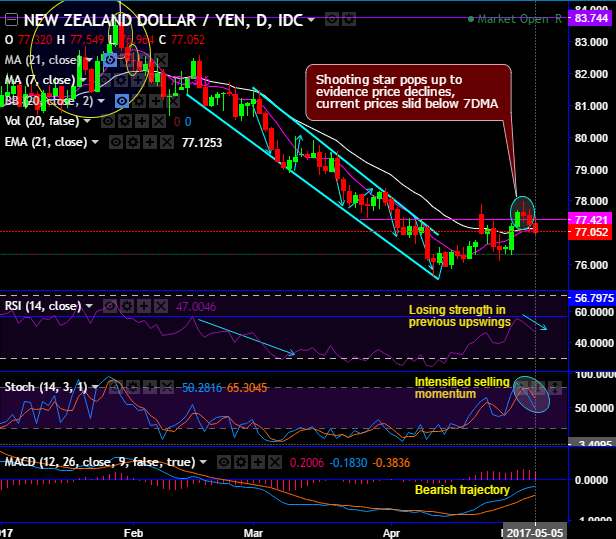

Shooting star pops up at 77.566 levels to evidence price declines, as a result current prices sliding below 7DMA (refer daily charts). Gravestone Doji rightly placed at resistance at 81.019 levels, you’ve seen the resultant bearish reflections thereafter, managed to slide below 38.2% Fibonacci retracements. Can bears continue the major downtrend? This would be answered by both leading and lagging indicators (refer monthly charts).

NZDJPY price, volumes, leading and lagging indicators moving in tandem with bull swings.

While both leading & lagging indicator to substantiate bearish stance, MACD remaining in bearish trajectory does not substantiate this standpoint but this would be deemed as indecisiveness in current rallies.

RSI converges to the ongoing price dips as this leading oscillator trending below 45 levels which is the caution for aggressive bears, the same has been the case when you’ve to plot daily charts, it signals weakness as it touched 57 levels.

Bearish momentum in short term selling sentiments is intensified as stochastic oscillator evidences %D crossover which is again bearish signal.

Hence, we recommend shorting rallies on hedging grounds and decide to initiate shorts in futures contracts with near month tenor.

Well, at spot reference: 77.052, contemplating lingering bearish indications, on hedging grounds we recommend shorting near-month month futures as the underlying spot FX likely to target southwards 76.259 levels in near run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.