Well, after looking at the title of this write up one may have come up here with the heavily bullish mindset, but in reality, it isn’t that encouraging for the bulls of this pair than it really seems at this juncture.

Amid 6-8 months of consolidation phase in major bearish trend, a gravestone doji pattern occurred at the peaks of 81.019 levels (refer last month candlestick).

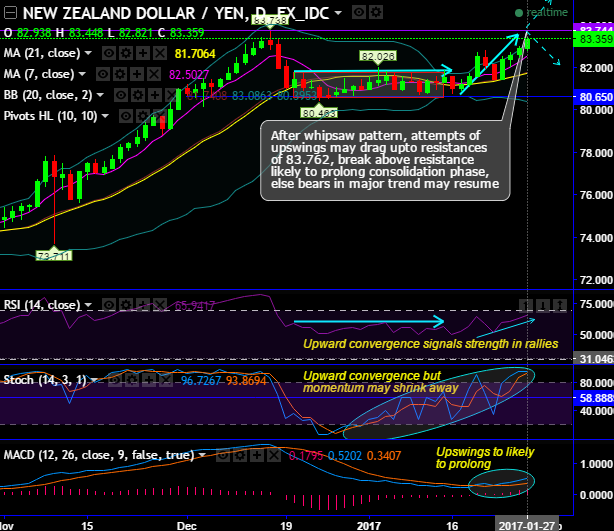

From last week, the price upswing was able to come out of the tight range that persisted since 20th December, the prevailing attempts of upswings further restrained below a stiff resistance of 83.762 levels, break above these levels likely to drag more rallies, else bears have equal opportunities on the contrary.

RSI converges to the ongoing upswings as this leading oscillator trending near 70 levels on both daily as well as the monthly chart which is overbought zone.

Buying momentum in short term rallies are not convincing by the stochastic oscillator as there could be attempts of %d crossover above 80 levels which is again overbought zone, but this indication is in favor of the consolidation phase. MACD here signals the bullish trend to prolong ahead.

Bulls in January month series have managed to bounce back despite this bearish occurrence, upswings may drag further up to 83.762 by shrugging off this bearish formation given a breach of this stiff resistance levels maintaining the same momentum in rallies.

The upswings have gone above EMAs, now on the verge of bullish EMA crossover (7EMA crosses over 21EMA).

But from 2015 up to mid-2016 the major trend has been bearish supported by both leading and lagging oscillators’ indications. From last six the trend showing strength again but we advise to wait until the breach of above-stated levels, thereafter contemplating the prevalence of healthy bullish indication the trend could be deemed as the reversal.

For now, NZDJPY price, volumes, leading and lagging indicators moving in tandem with bull swings.

While both leading & lagging indicator to substantiate this bullish stance.

Hence, we recommend using these rallies for trading via leveraged instruments, on intraday terms, as RSI still noises with strong momentum in buying interests as they are converging to the ongoing upswings, we advocate staying long via one touch binary call options for a target of 40-50 pips. On the flip side, stay short in mid-month futures on hedging grounds as more slumps are on the cards in the weeks to come.