- NZD/JPY retraces dip below 5-DMA on better-than-expected Caxin China manufacturing PMI data.

- Data released earlier today showed China Caixin manufacturing PMI came in at 51.7, above expectations (50.6) in December.

- The pair is up 0.19% on the day, trading at 80.13 after hitting highs of 80.29.

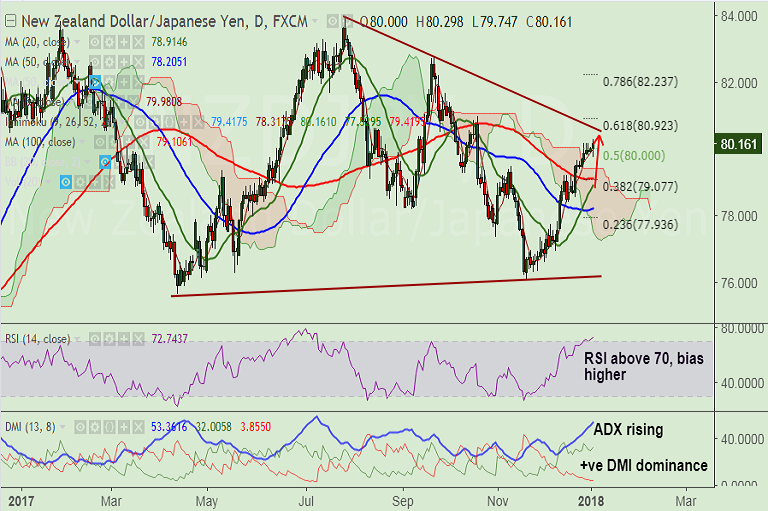

- RSI is showing strength above 70 levels with room to run further, momentum is also highly bullish.

- ADX is above 25 levels and rising further along with +ve DMI dominance which supports current uptrend.

- Technical indicators are bullishly aligned and we see scope for further upside, 80.65 (falling trendline) is next bull target.

- The pair is trading in a falling triangle pattern and violation at 'Triangle top' could see further upside.

- On the flipside, retrace below 200-DMA at 79.31 negates bullish bias.

Support levels - 79.98 (5-DMA), 79.41 (cloud top), 79.31 (200-DMA)

Resistance levels - 80.65 (Triangle top), 80.92 (61.8% Fib retrace of 83.910 to 76.090 fall), ), 81.72 (200W SMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-JPY-capped-below-200-DMA-at-7928-further-upside-only-on-break-above-1058132) is approaching TP3.

Recommendation: Book partial profits at highs, hold for 80.70/ 81/ 81.75.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -94.1809 (Bearish), while Hourly JPY Spot Index was at -53.1461 (Neutral) at 0800 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest