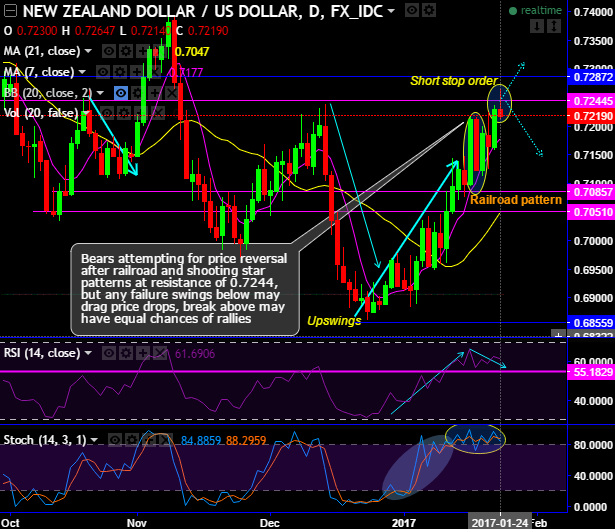

Despite the attempts of bull swings for the day upto the highs of 0.7264 levels, bears have managed to pull it back, we could now foresee more slumps in the days to come. Below analysis explain you why:

Please note that “Railroad pattern” occurred at around 0.72 levels, as a result, upswings are now struggling to clear stiff resistance at 0.7245 levels. While bears attempting for price reversal after this bearish pattern (railroad pattern) in addition to the shooting star patterns at the same resistance level.

Any failure swings below stiff resistance of 0.7245 levels may drag price drops; break above may have equal chances of rallies.

Back-to-back shooting star patterns are occurred at 0.7239 and 0.7231 levels successively to evidence downswings below 7SMA (refer 4H chart), the slumps may extend upto channel support, the selling interests are cushioned by bearish momentum.

Consequently, the intraday prices have gone below 7SMA (refer 4H chart), any abrupt upswings to bounce back may drag rallies maximum upto 0.7245 where next immediate resistance is seen.

To substantiate this bearish stance, both leading indicators (RSI & stochastic curves) evidence the bearish convergence that signals strength and momentum in selling interests.

Trade tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 0.7245 and lower strikes at 0.7177 levels.