The next upside target is 0.7130 (50% retracement of Feb/Mar decline).

But we’ve been neutral in a 0.7130-0.7240 range for Kiwi dollar against US dollar.

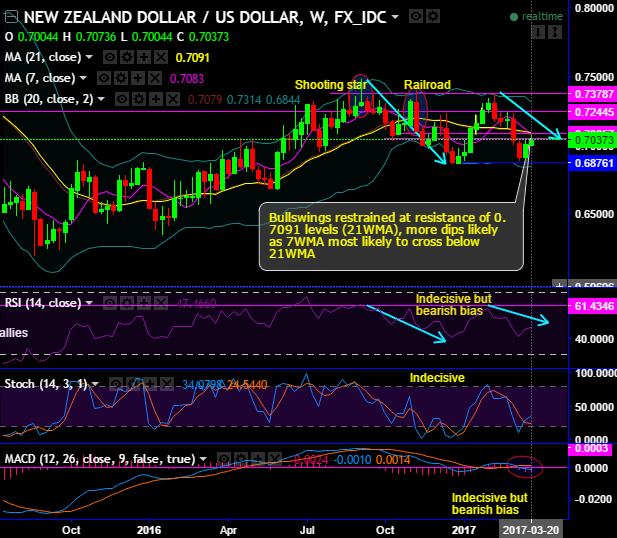

Next strong resistance is seen at 0.7091 levels.

Bull swings restrained at the resistance of 0.7091 levels (21WMA), more dips likely as 7WMA most likely to cross below 21WMA.

On broader perspective, shooting star is traced out 0.7283 levels that evidences the steep slumps (refer monthly charts), consequently, bearish candles with big real bodies and upper & lower shadows occurred consecutively that they finished to seem like 3-black crows.

To substantiate this stance, both leading indicators (RSI & stochastic curves) evidence the bearish convergence although a bit indecisive that signals selling momentum in on both weekly as well as monthly terms.

MACD on the other hand, evidences bearish crossover to signal weakness and dips minimum upto 0.6959 levels.

Trading tips:

While on hedging grounds, the short futures position are advised which is an unlimited return and unlimited risk position that can be entered by the foreign trader who has exposure towards USD payable exposure to profit from a rise in the price of the underlying spot fx.