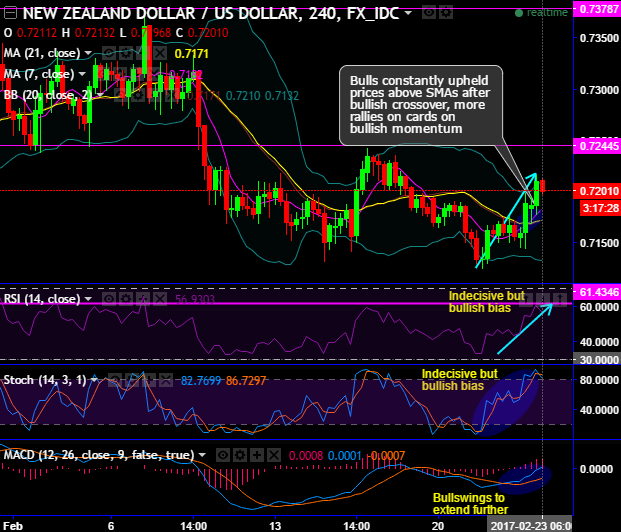

We’ve been neutral in a 0.7130-0.7240 range for Kiwi dollar against US dollar.

Next strong resistance is seen at 0.7245 levels.

Major resistance is seen at 0.7410 levels.

When you’ve to observe the consolidation phase of this pair, the trend remains intact upon bullish SMA crossover and engulfing patterns.

The New Year trade (January) series for NZDUSD has been extremely in bulls favor, the upswings from the lows of 0.6885 to the current 0.7313 levels, last month candle, for now, seems to be the bullish engulfing pattern.

These sharp rallies appear to be the substantiation for the consolidation phase that had begun since September 2015.

On a broader perspective, shooting star is traced out 0.7283 levels that evidences the steep slumps (refer monthly charts), consequently, bearish candles with big real bodies and upper & lower shadows occurred consecutively that they finished seemingly like 3-black crows.

In contrast, bulls bounce back with engulfing pattern to resume consolidation phase, rallies rejected again at the stiff resistance of 0.7409 levels, but buying interests are cushioned by momentum & trend indicators.

To substantiate this stance, both leading indicators (RSI & stochastic curves) evidence the bullish convergence although a bit indecisive that signals strength and momentum in buying on both weekly as well as monthly terms.

MACD on the other hand, evidences bullish crossover to signal extension of bull swings minimum up to 0.7241 levels.

Trading tips:

For intraday trading perspective, it is advisable to buy one touch binary calls on every dip which resembles like a naked vanilla call option, so stay long via this leveraged instrument at spot reference: 0.7205 level for a target up to 30-40 pips (i.e. next immediate resistance of 0.7245 levels) within the binary expiry duration.

While on hedging grounds, the long futures position are advised which is an unlimited return and unlimited risk position that can be entered by the foreign trader who has exposure towards NZD payable exposure to profit from a rise in the price of the underlying spot fx.