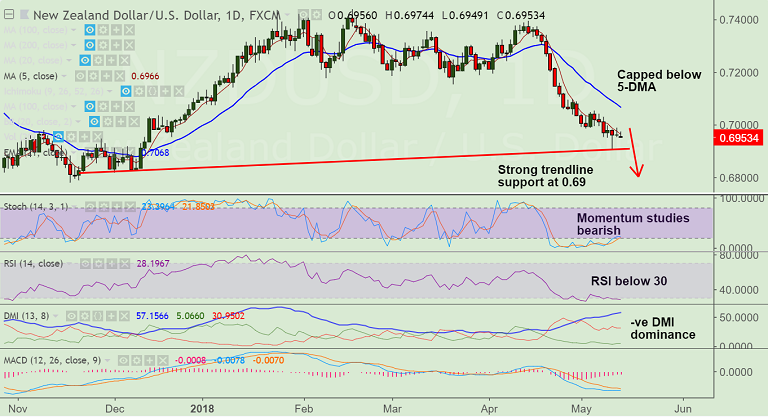

- NZD/USD rejected at highs, retraces brief break above 5-DMA at 0.6966, currently trades at 0.6954 levels.

- Momentum studies are bearish, RSI below 30 levels and we see -ve DMI dominance.

- Kiwi trades muted ahead of the New Zealand government budget later this week.

- The Reserve Bank of New Zealand (RBNZ) has turned dovish in the face of a lopsided New Zealand economy.

- The pair finds strong trendline support at 0.69. Break below will accentuate weakness. Scope then for test of 0.6780 (Nov 17 low).

- On the flipside, 21-EMA at 0.7068 is strong resistance. Minor bullishness on break above.

Support levels - 0.69 (trendline), 0.6780 (Nov 17 low)

Resistance levels - 0.6966 (5-DMA), 0.70. 0.7068 (21-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -118.024 (Bearish), while Hourly USD Spot Index was at -15.6627 (Neutral) at 0545 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.