NZD/USD chart - Trading View

NZD/USD was trading 0.23% lower on the day at 0.6118 at around 09:40 GMT.

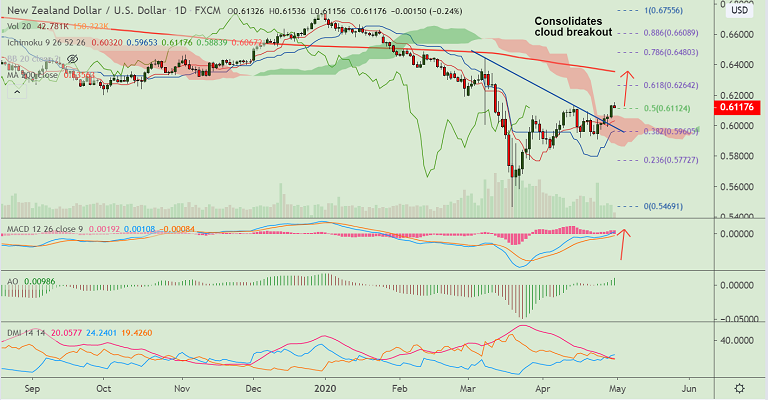

The pair is likely consolidating previous session's gains, bias higher as long as pair holds above daily cloud.

Antipodeans weaken across the board after softer-than-expected China PMI data.

National Bureau of Statistics (NBS) report earlier today showed China December Caixin manufacturing PMI came in at 49.4 vs. 50.1 last.

Meanwhile, purchasing managers' index (PMI) for China's manufacturing sector arrived at 50.8 in April, while Non-Manufacturing PMI rose from 52.3 prior to 53.2.

On the other hand, the ANZ Business Confidence for New Zealand, for April, recovered from -69.5 expected to -66.6 but Activity Outlook dropped below -26.7% previous mark to -55.1%.

Cloud breakout has raised scope for further upside in the pair. Momentum studies are bullish.

Resumption of upside will see test of 61.8% Fib at 0.6264. Retrace below 55-EMA to see weakness. Breach below cloud confirms bearish resumption.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data