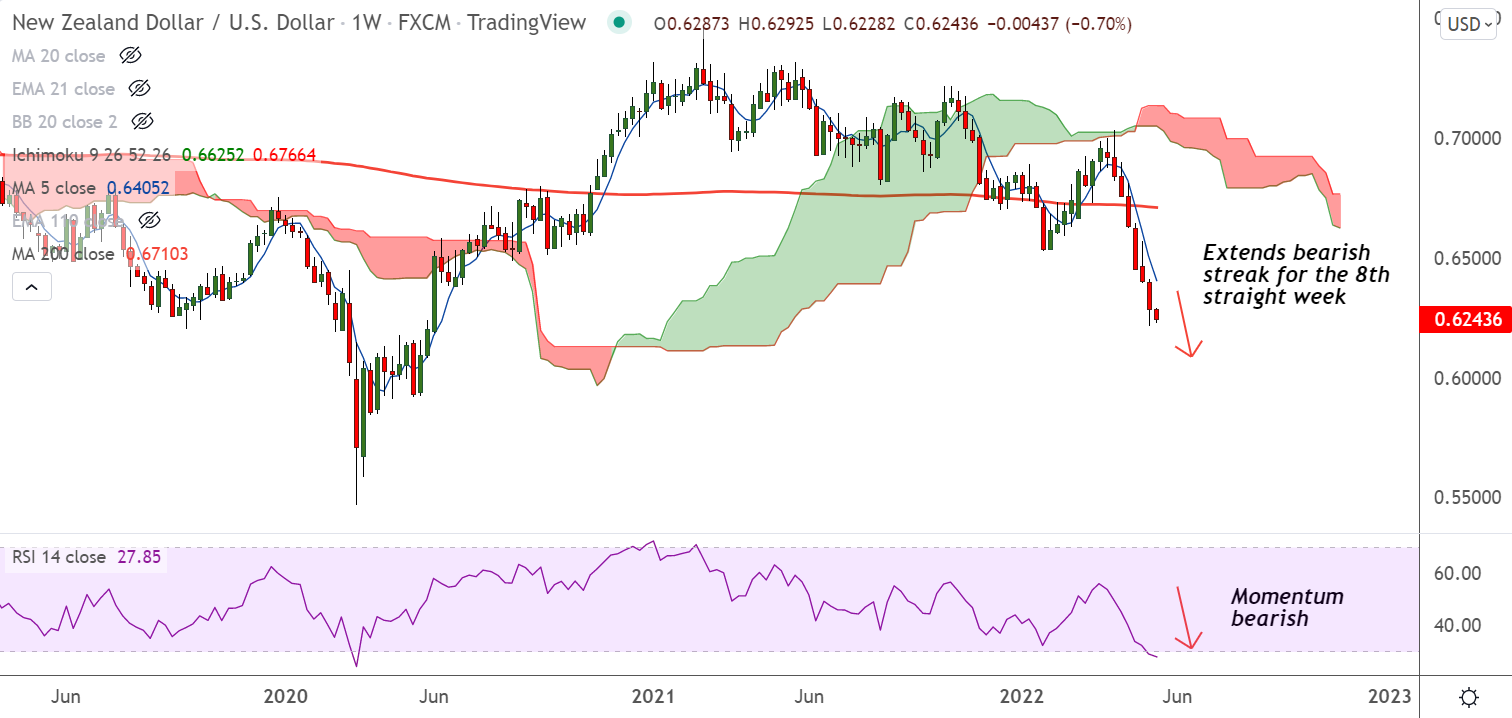

Chart - Courtesy Trading View

Technical Analysis:

- NZD/USD was trading 0.75% lower on the day at 0.6241 at around 04:15 GMT

- The pair has erased most of the previous session's gains and is poised to test new 2-year low

- Bearish streak continues for the 8th straight week, technical indicators show further weakness

- GMMA indicator shows major and minor trend are strongly bearish. MACD and ADX support downside

Fundamental Overview:

China's April retail sales plunged 11.1% on the year, almost twice the drop forecast, while industrial output dropped 2.9%, also missing analysts' expectations for a slight increase.

Shockingly weak data from China underlined the deep damage lockdowns were doing to the economy.

Meanwhile, “China’s Stats Bureau Spokesman expects economic operations to improve in May,” cushions downside in the pair.

Major Support Levels:

S1: 0.62

S2: 0.6138 (Lower BB)

Major Resistance Levels:

R1: 0.6266 (5-DMA)

R2: 0.6351 (200H MA)

Summary: NZD/USD trades with a bearish bias. Scope for test of new yearly lows below 0.62 handle.