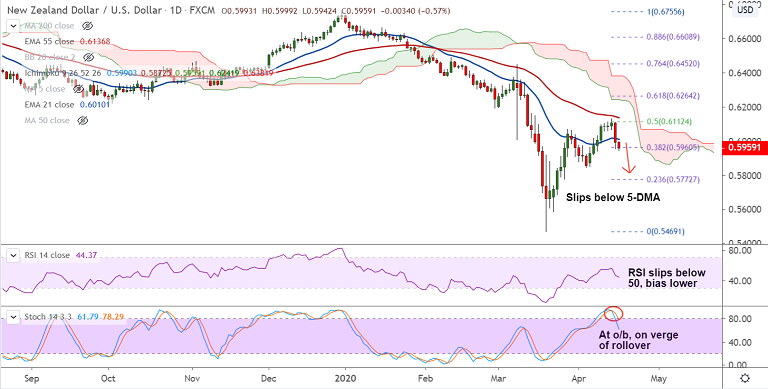

NZD/USD chart - Trading View

NZD/USD is extending weakness for the 2nd straight session, bias is turning bearish.

The pair was trading 0.52% lower on the day at 0.5965 at around 06:40 GMT.

Price action has slipped below 21-EMA support, technical studies are turning bearish.

Major and minor trend as evidenced by GMMA indicator are bearish. Price action has slipped below 200H MA.

Fears of impending global recession and the resultant haven demand for the US dollar keeps downside pressure.

Technical studies are poised for bearish reversal. Stochs are on verge of rollover from overbought levels.

Upside capped below 0.60 handle. Bears eye April lows at 0.5843. Next major support aligns at 23.6% Fib at 0.5772.

Support levels - 0.5949 (20-DMA), 0.5872 (Kijun Sen), 0.5772 (23.6% Fib)

Resistance levels - 0.6010 (21-EMA), 0.6047 (5-DMA), 0.6136 (55-EMA)

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch