- NZ Balance of Payments Current account deficit for Q2 came in at 945mln versus -295mln expected and against a surplus of 1306mln seen previously.

- New Zealand posts narrowest current account deficit since 2Q 2014, however, kiwi bulls ignored upbeat data.

- The pair is marginally higher on the day, trading around 0.7264, up 0.19 percent on the day.

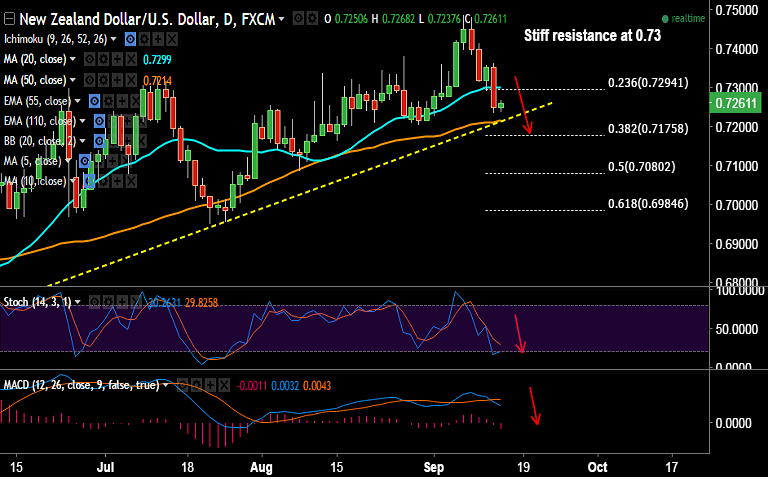

- Stiff resistance seen around 0.73 levels (20-DMA at 0.7299 and 23.6% Fib at 0.7294), upside to resume on break above.

- Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-bias-turns-bearish-on-break-below-5-DMA-good-to-sell-rallies-278363) has almost hit all targets.

- Major support levels - 0.7214 (50-DMA and trendline), 0.7175 (38.2% Fib), 0.7164 (Aug 15 low)

- Major resistance levels - 0.7265 (double top Aug 30,31), 0.7294 (23.6% Fib), 0.7299 (20-DMA)

Recommendation: Good to sell rallies around 0.7265/75, SL: 0.73, TP: 0.7214/ 0.72