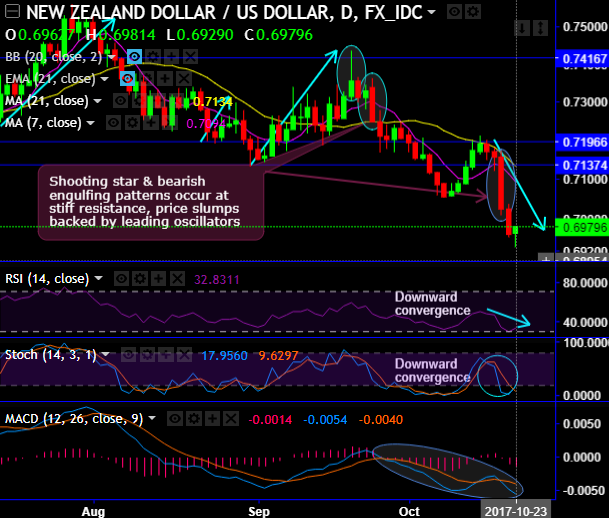

The current price of this pair has slid below DMAs especially after bearish engulfing pattern candle has occurred at 0.7025 levels (refer daily chart).

We’ve already stated in our previous post that this pair pops up with the bearish pattern candles that have now hampered the momentum in the consolidation phase at 50% Fibonacci levels.

For now, we foresee more dips after sliding below 38.2% and 7 and 21EMAs.

In our previous write up, we traced heaps of bearish indications for NZDUSD, consequently, we’ve been seeing steep slumps from the last three months.

The major trend seems to have been exhausted at 50% Fibonacci retracements. That’s where a bearish engulfing candle has occurred at 0.7176 levels followed by a shooting star candle at 0.7204 levels (refer monthly chart).

As a result, on daily terms also, Shooting star & bearish engulfing patterns occur at 0.7355, 0.7248 and now at 0.7025 levels respectively (refer daily chart).

The occurrence of these bearish patterns at stiff resistance zones of 0.7416 – 0.7379 is more noticeable, historically, the rallies have been restrained below these resistance levels.

You could make out that amid this downswings, the bears have managed to break below major strong supports at 0.7244 (21DMA) and 0.7196 levels, consequently, we could foresee more slumps upon these flurry of bearish indications.

Both leading oscillators (RSI and Stochastic curves on daily terms) have been constantly converging to the ongoing price dips that signal the strength and intensified momentum in the bearish trend.

The current price is now below psychological levels of 0.70.

On a broader perspective, the bulls extended rallies above EMAs in consolidation phase but again restrained below 50% Fibonacci retracements from the lows of 0.6196 mark (refer monthly charts).

Well, contemplating above technical rationale in both short and intermediate terms, we advocate tunnel spreads snapping rallies to target upto 0.6929 levels (i.e. around another 50-60 pips southwards from the spot reference of 0.6989). Use upper strikes at 0.7020 and lower strikes at 0.6929, these leveraged instruments are likely to fetch magnified effects in payoff structure as long as underlying spot FX keeps dipping.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -30 levels (which is bearish), while hourly USD spot index was at shy above 12 (neutral) at the time of articulating (at 06:15 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: