NZD/USD chart - Trading View

NZD/USD was trading 0.13% higher on the day at 0.7177 at around 07:00 GMT, outlook neutral.

The pair was extending marginal gains on the day as positive credit review report by Moody's supports kiwi.

Moody's Investors Service in its new credit review report on New Zealand’s economy said that New Zealand has a robust fiscal position and a negative rating action is unlikely.

On the data front, New Zealand’s CPI data printed in line with expectations and failed to put a bid under the kiwi.

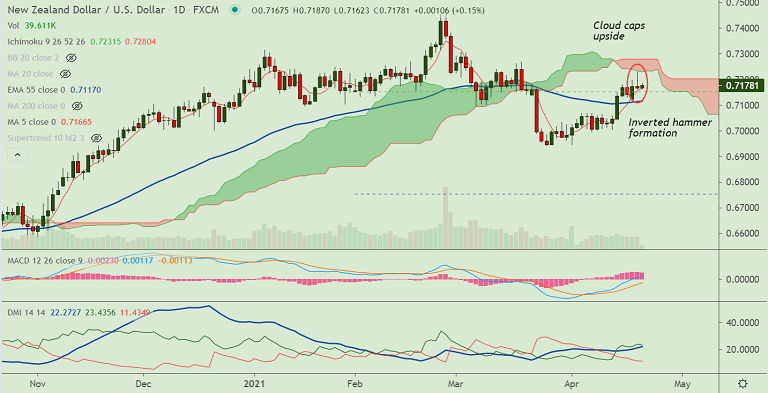

Major trend in the pair as evidenced by GMMA indicator is neutral. The pair closed Tuesday's trade with an inverted hammer formation.

Upside in the pair was rejected at daily cloud. Price action is currently holding support at 5-DMA at 0.7165. Break below will see some weakness.

Pullback is likely to find strong support at 55-EMA at 0.7116. Overbought conditions may cause some downside.