China earlier yesterday produced up an upbeat CAIXIN manufacturing PMIs, the data has outpaced the forecasts, actual 50.3 versus forecasts at 49.9 and the previous flash of 49.6.

On the back of this Chinese data, bulls of NZDUSD are sensing strong supports at 0.7295 levels (i.e. 7DMA, refer daily charts).

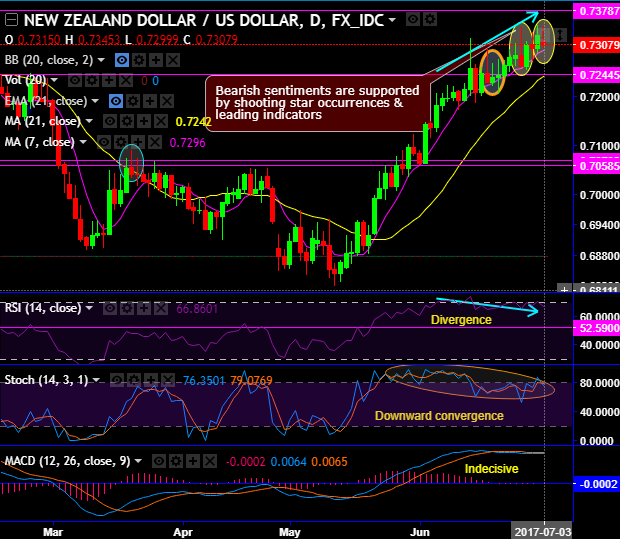

Although there has been the lingering bullish sentiment in the short run, the ongoing rallies are unlikely to show stern moves above 0.74 levels as shooting star pattern candle are traced out to signal weakness at this juncture.

Shooting star candle patterns have occurred at 0.7262 and 0.7309 levels (on daily charts).

The next stiff resistance is seen at 0.74 levels.

While RSI evidences bearish divergence: The Relative Strength Index (RSI) technical indicator, which compares the magnitude of recent gains with the magnitude of recent losses, is used by chart watchers to gauge the momentum of a market trend. Bearish divergence’ is a warning to investors not to buy the dip in the panicky markets.

Any break below 7DMA may attract the trend to slide towards next strong support at 0.7245 marks.

Most importantly watch for the day, if there is no momentum achieved from the current levels then we foresee most likely bearish candlestick patterns either shooting star or gravestone doji pattern that is likely to signal weakness and resume downswings below 7DMAs again.

On the flip side, on monthly terms despite the bullish swings from last two months bulls are struggling for the momentum in the consolidation phase in major trend, rallies on this plotting are again restrained below stiff resistance of 0.74 levels, momentum on this timeframe has been indecisive or slightly bearish bias (refer monthly plotting).

To substantiate this indecisiveness, MACD has also not signaled the continuity in prevailing rallies (refer both daily and monthly charts).

While aggressive intraday speculators can also bet on further upswings upto next stiff resistance levels (0.7350 or maximum upto 0.74 levels).

Trade tips:

Contemplating above technical reasoning, on trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 0.7350 (30-40 pips tolerance levels to above stated resistance) and lower strikes at 0.7280 (around 20-30 pips, i.e. near 7DMA levels), the strategy is likely to fetch leveraged yields as long as underlying spot FX remains within these strikes on or before the binary expiry duration.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 29 levels (which is mildly bullish), while hourly USD spot index was at a tad below -115 ( highly bearish) at the time of articulating (at 06:58 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: