Throughout previous articles, we suggested to our readers that fundamentals are in place for a large-scale price recovery in natural gas and only hindrance to that remains the very high level of inventory. We even called on our traders to go long in natural gas at $2.6 per MMBtu with targets around $3.1, $3.7, $4.3 and $5.2 per MMBtu. After the price reached $3.7 per MMBtu, we found the natural gas to be struggling and we recommended to our readers to go short targeting $2.7 per MMBtu as the winter in North America hasn’t been as freezing as required to significantly reduce the inventory.

Due to weak winter in the previous two years, despite a slowdown in the production in 2016, the natural gas inventory hit the highest level on record above 4 trillion cubic feet. Currently, the inventory has fallen to 3.16 trillion cubic feet; large reduction but not enough to boost gas prices.

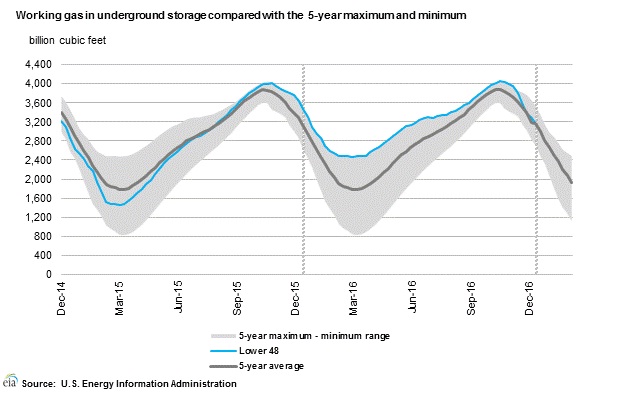

The above two chart explains the inventory situation in greater details. The first chart from EIA shows that the decline in the inventory in line with its 5-year average; not enough to lead to a significant reduction from a record-high level of inventory.

The second chart is from investing .com that shows weekly inventory drawdowns and it is visible in the naked eye that we have already passed peak inventory drawdown. In December 29th report inventory drawdown hit 237 billion cubic feet. Since then, in the past two weeks inventories just declined by a total of 200 billion cubic feet; certainly not sufficient to lead to a major drawdown in the levels of inventory.

Natural gas prices are currently trading at $3.39 per MMBtu and we expect selling pressure due to this high level of inventory.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX