Live September meeting should keep 2M vol supported; while yen 1-3m risk-reversals still a better sale.

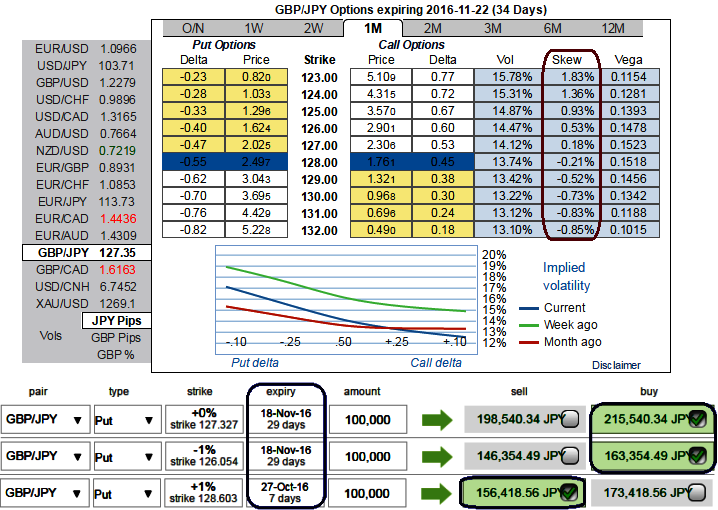

Please be noted that the 1m GBPJPY IV skews are more biased towards OTM put strikes.

From the IV nutshell one can understand that the negatively skewed IVs in 1m contracts would imply that the underlying spot FX is less likely to remain in ITM territory or in other words spot FX would shift towards OTM strikes.

Hence, writing such less favourable options would cushion the cost of any downside hedging strategies. For an instance, as shown in the diagram, using a narrowed expiry (1%) ITM shorts would reduce the cost of 2 lots of longs in ATM and OTM puts.

The significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

As shown in the diagram, 1m tenor has successively rising IVs above 14% which is on higher side, since the spot Fx of underlying pair is rising along with IVs, this is good news for option writers as such options with a higher IV costs more. Thereby, writers are likely to receive more premiums.

The traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

Well, on the contrary, if the same IV during longer tenors keep increasing and you are holding an option, this is good for holders as well. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

There was also a valuation issue at play, in that yen vols had lagged the sharp collapse in VXY prior to BoJ –held up in all likelihood by the outside chance of a policy regime shift in Japan –and were ripe for a sell-off if the meeting proved uneventful.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis