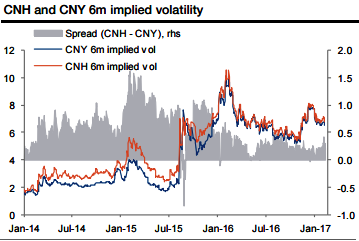

The options trades are preferable over forwards as the implied volatility is similar between CNH and CNY (CNH vol is 0.2 vol points higher than CNY vol in the 6m tenor) and the vol spread has been narrowing over time.

These conditions provide interesting option-based relative value strategies, where investors can enter zero cost structures (plus/minus a few basis points depending on spot, points, and vol) to position for the CNH-CNY basis flipping.

A notable advantage of the option strategy is that positioning for the basis to flip is contingent on RMB depreciation (topside strikes), whereas a position in forwards could underperform and has greater MTM risk if the RMB strengthens or is stable.

Our base-case scenario envisions USDCNY rising to 7.30 by the end of 2017. The structural richness of implied volatility over realized argues for short volatility structures. Additionally, short downside volatility is appealing because there are few fundamental reasons for the CNH to trade meaningfully stronger over the next year. Owning a 1yr USDCNH zero-cost seagull structures have consistently been advocated (6.90/7.20/7.50, zero cost) offers a maximum gain of 4.1%. With no digital risk involved and limited convexity, the position can be conveniently delta-hedged. Losses are unlimited if USDCNH trades below the 6.90 strike in one year.

The structure is a standard 1y call spread strikes 7.20/7.50 fully financed by selling a put strike 6.90, exposed to a maximum USDCNH appreciation of 4.1% at expiry.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential