The global economy is surfing a cyclical upturn, and financial markets have been gorging on central bank accommodation, but as post-crisis policies are dismantled, the appearance of calm in FX-land risks being deceptive.

The Fed was first out of the blocks with a strong policy response to the global financial crisis, prompting the Brazilian finance minister to bemoan ‘currency wars’. The election of Shinzo Abe as Prime Minister of Japan brought the BoJ into the fray, and by the start of 2015, the ECB had joined in and a significant dollar rally was underway.

As the ECB edges towards normalization, an undervalued euro has room to rise further, and even if the BoJ is committed to its current stance, the yen’s a dormant volcano only in the sense that it hasn’t erupted for a couple of years.

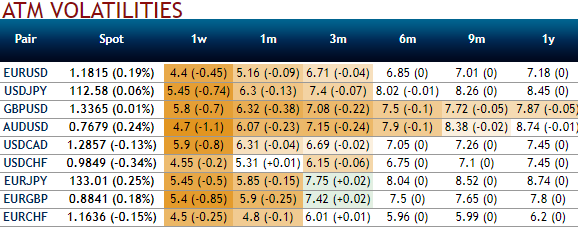

Despite a packed week of central bank meetings and data releases, 2017 the trading year is going out rather quietly into the night as far as FX vol markets are concerned (refer above nutshell showing lackluster ATM IVs). Fireworks of last December are conspicuous by their absence this time around, with any chance of a last hurrah for the dollar in a rather forgettable year dashed by no changes to the FOMC’s plan of three unhurried hikes amid strong, non-inflationary growth in 2018.

VXY has once again collapsed to the lows of the year with Fed risks out of the way and the holiday season in sight and delta-hedged returns over the past 2-weeks across various G10 FX blocs have been in the red with the exceptions of CAD - (oil related whipsaw) and SEK - (post-CPI beat gyrations) crosses (refer above chart).

Of the latter, sharp SEK strength after a strong CPI print is a reasonable template for what might be expected of similar surprises in other currencies next year and is a potential source of thematic alpha for vol investors willing to do the hard yards of event trading with short-dated options. CAD-cross vols are also of interest as a potential buy given NAFTA risks in 2018, and CAD correlations that trade at a substantial discount to trailing realized corrs are well priced as carry friendly trade disruption hedges.

More tactically, option books heading into the year-end could do worse than to own these two recent vol outperformers funded with the bottom two (GBP and USD), since short-horizon relative return momentum of delta-hedged straddles has historically proven to be a reliable factor for volatility risk allocation across currency blocs, outperforming naïve sell-and-hold benchmarks (refer above chart).

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell