Tactically increase long NOK exposure: stay long NOK vs. 50:50 basket of GBP and CAD; buy NOK vs. USD outright

Last week, we initiated long NOK exposure as way to obtain exposure to the global recovery trade. This was expressed via GBP and CAD, both currencies which in our view are vulnerable to idiosyncratic factors (increased no-deal odds on no extension of transition period deadline for GBP; oil sector consolidation and BoP risks from CAD).

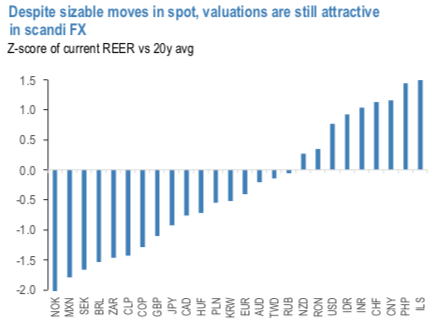

By contrast, NOK was expected to benefit from not only a myriad of domestic factors such as Norges Bank buying of NOK to fund fiscal stimulus (purchases are expected to be in the ballpark of 11% of GDP in 2020), central bank resistance to negative rates/ QE and supportive external/ fiscal balances (refer 2nd chart), but also by global ones if a recovery were indeed to ensue. In the latter scenario, not only are oil prices expected to be higher which should help a petro currency like NOK but also distressed currency are expected to outperform. The valuations angle is certainly NOK-supportive since, as shown in 1st chart, NOK (alongside SEK) features as among the cheapest currencies in G10 FX.

This week we also initiate outright long NOK exposure vs. USD. The primary motivation is to increase beta to the global recovery trade since data over the past week has confirmed that this is indeed underway as lockdowns are easing. This improvement is now evident in all metrics we follow, both on the traditional side and also the newer, higher frequency ones. Specifically, our economists’ forecasts have now been stable for six weeks; our EASIs (economic activity surprise indices) have been positive in most countries we cover for a multi-week period, meaning, that on average, activity data is beating expectations; manufacturing PMIs turned up in May and the timelier Google Activity Indices are inching up. This is not to say that uncertainties still don’t linger—US-China tensions and possibility of second wave infections are indeed still a major risk—but we take our cue from the timelier indicators of growth and express this via the select high beta FX where fundamentals are relatively solid.

Key Norwegian data this week was the oil and gas investment survey which was better than Norges Bank expectations; the regional network survey next week is the next important even on the calendar. Growth indicators will likely be more important to NOK price action than inflation which is also due to be released next week. We will also continue to track global indicators to confirm that the recovery remains on track and hence this trade should be considered tactical in nature.

Trade tips:

Stay long NOK vs. 50:50 basket of CAD and GBP, at an average spot rate of 9.524, and a separate stop losses at 12.310 for GBPNOK and 7.220 for CADNOK. Marked at +1.57%.

Buy NOK vs. USD at 9.289. Stop at 9.600. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?