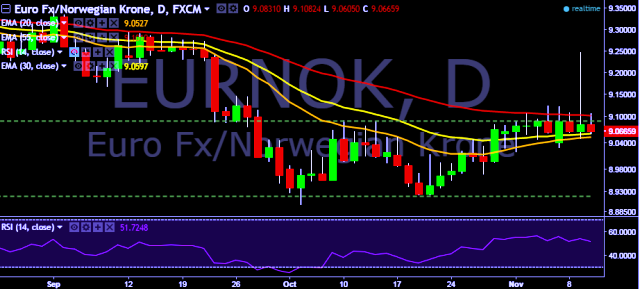

- EUR/NOK is currently trading at 9.0650 levels.

- It made intraday high at 9.1082 and low at 9.0605 levels.

- Intraday bias remains neutral till the time pair holds key resistance at 9.0958 marks.

- A sustained close below 9.0487 will test key supports at 9.0285, 8.9960, 8.9701, 8.9556, 8.9375, 8.9227 and 8.9011 marks respectively.

- On the other side, a consistent close above 9.0958 will take the parity higher towards key resistances at 9.1257/9.1463/9.1685/9.2023 marks respectively.

- Norway's October core CPI +2.9 pct yr/yr - Statistics Norway (RTRS poll +2.9 pct).

- Norway's October core CPI +0.2 pct mo/mo - Statistics Norway (RTRS poll +0.1 pct).

- Norway's October CPI +3.7 pct yr/yr - Statistics Norway (RTRS poll +3.5 pct).

- Norway's October PPI -4.5 pct yr/yr - Statistics Norway.

- Norway's October CPI +0.5 pct mo/mo - statistics Norway (RTRS poll +0.3 pct).

We prefer to go short on EUR/NOK around 9.0750 with stop loss at 9.1257 and target of 9.0487/9.0285.