Reversal signal is generated from series of bearish candles at whipsaws on 7DMA. Long term trend has been puzzling if you see the monthly charts of EURAUD.

Hedging Frameworks:

Well, ahead of monetary policy season by ECB and RBA, he decisions that may lead EURAUD fluctuations can be mitigated through 'Debit Put Spreads (DPS)',

AUD is likely to gain against euro in the weeks to come which is why shorts in spread are recommended, but any upswings in abrupt (if you monthly technical charts) should be capitalized as writing opportunity to deploy these shorts so as to reduce the hedging cost. While longs are anyhow keeps track of potential slumps.

Most importantly, 1W ATM IVs are stagnant which is good news for option writers, volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money which is not happening in this case, so shorts could be viewed as safe havens.

But, the biggest challenge is to choose which instruments to be deployed on long side during such steady flow of IVs.

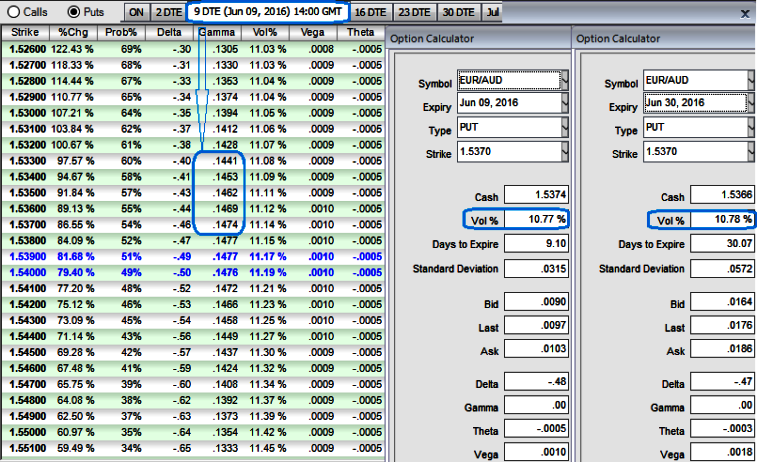

Well, here goes the recommendation to tackle the trend and IVs, at current spot FX is trading at 1.5360, since we expect more dips extending below 1.5343 levels in medium terms, aggressive bears can initiate strategy using ATM puts with reasonable gamma showing 40% delta and higher probabilities as shown in the diagram.

Gamma is always a positive value, therefore you add Gamma to the value of the current Delta to estimate the new Delta in a rising market and you subtract Gamma from the current Delta to estimate the new Delta in a falling market. we've chosen slightly OTM contract here in this case (just 30 pips above), because gamma at ATM was comparatively higher for just 6% of delta difference.

But unlike a simple naked puts, backspreads have an extra long that has not only leveraging effects, a short option at a lower strike that caps your reward but also reduces the net cost of the trade.

So, the recommendation for now is to go long in 2W (0.25%) OTM -0.40 delta put, and simultaneously short 1W (1.5%) ITM put with positive theta or closer zero.

As the strikes have been narrowed, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis