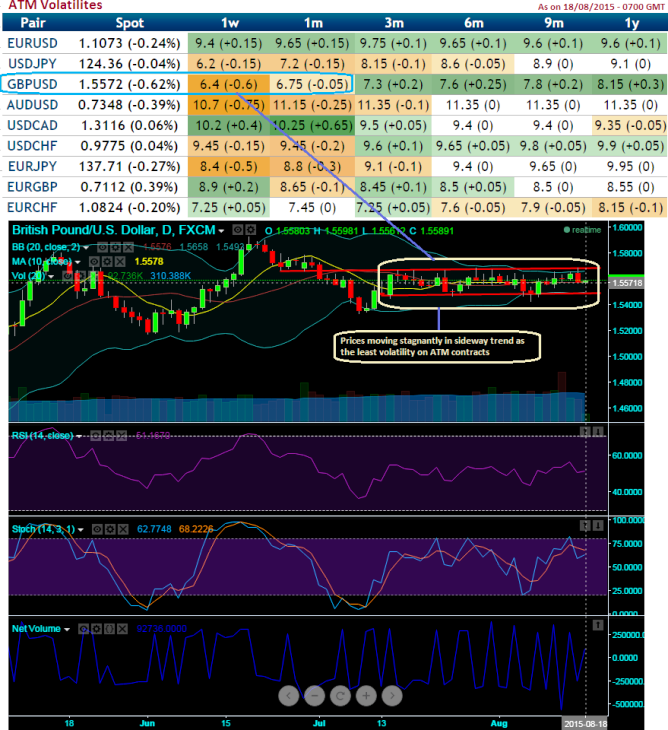

There is no significant news apart from CPI and retail sales UK side except that could propel GBP for this week and near future GBPUSD may likely to experience low volatility (see ATM vols nutshell). You can make out from the nutshell; GBPUSD is to have the least IV. On data front, GBP/USD continues to adjust lower as markets await UK July inflation data due 0830GMT. A disappointment in the data could weigh on the cable, pair could dip to 1.5535. Delta risk reversal also suggests sideway to slightly bearish trend.

Currency option strategy: Naked straddle shorting GBP/USD

GBP/USD = 1.5688 (upper bracket) - 1.5480 (lower bracket) = should move within the range of 210 pips.

Since the GBPUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs, so here comes straddle shorting using at the money instruments keeping 200-225 price range.

GBP/USD's non directional pattern is persisting but some bearish sentiments are indicating slightly downward movements, Moving average is creeping like a straight line from more than a month or so. As we foresee non-directional trend on EOD charts we like to remain in safe zone and recommend shorting a straddle using At-The-Money options, thereby, one can benefit from certain returns by shorting both calls and puts. Short ATM put and ATM call (strikes at 1.5585) simultaneously of the same expiry with positive theta value (preferably short term for maturity is desired).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?