The current global macro environment is characterized by weak economic volatility. One of the consequences is that FX volatility has been depressed since most of 2H’17. Sustained growth but still-soft inflation dynamics are ensuring that monetary policy normalization is a slow process so far, with limited risk of acceleration by central banks. The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock.

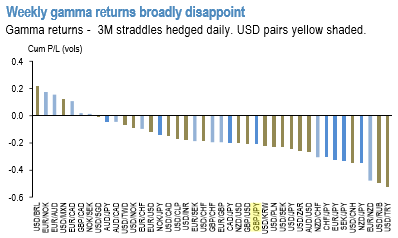

As a resultant effect of above-stated depressed and continued vols environment, FX gamma returns (refer 1st chart) suffered another week of pain as the busy calendar and fear from the US trade actions on the back of the Section 301 investigation report kept implieds supported but failed to revive realized vol (refer 2nd chart).

Moreover, April has consistently been the most FX vol downbeat month. That’s in part driven by vol supplying Japanese corporate hedging into new fiscal year that directly impacts back tenor yen and yen x-vol ultimately spilling over into higher beta currencies. The risk is that with the trade elephant still in the room, seasonal FX vol trends may be less notable this time around.

Since the onset of the trade protectionism theme a few weeks ago and amid potential for a major left tail risk event we have turned defensive.

Our lean remains defensive and we hold onto long cross-JPY vega in spread format (GBPJPY –USDJPY, BRLJPY – USDBRL), long EURUSD and EUR-cross (EURCAD) vol exposure and are short high dollar correlations (NZD vs. JPY) that should mean-revert lower if trade skirmishes intensify. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data