The Australian federal government’s mid-year fiscal update is expected to show a deteriorating deficit as broad economic weakness offsets commodity price gains. Markets will be watching for any rating agency reactions. The Aussie crosses remain edgy, especially pairs like AUDNZD, AUDJPY well below fair value estimates implied by interest rates, commodity prices, and risk sentiment.

A steady hand from the Fed in June plus an optimistic RBA should limit downside on AUDJPY during the next few months. Further out, though, the underlying AUD trend should be gently lower, as growing bulk commodity supply gradually cools the 2016 price surge. Iron ore should be back under $80/tonne by June, with further (modest) declines likely in H2 2017.

Aussie retail sales, trade balance and monetary policy data announcements are scheduled in 1st week of April, as a result, we think the pairs such as AUDJPY are blowing IVs crazily in OTC FX space that pops up with rising IVs above 11.61% for 1 month expiries having significance in economic drivers that propels this currency pair to anywhere. We see no data announcement in both continents except Aussie trade balance, retail sales and RBA monetary policy that are scheduled to be released in 1st week of April.

We think the same HY IVs with longer tenors are conducive and justifiable for option holders as there are series of considerable economic events lined up going forward.

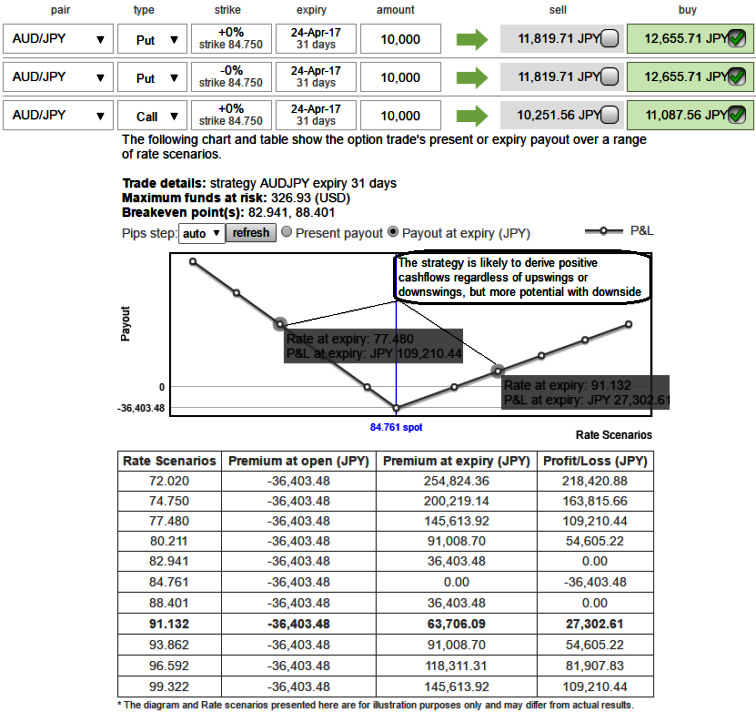

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap versus OTM put strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 1 lot of 1M ATM 0.51 delta calls and double the side (2 lots) of ATM -0.49 delta puts of 1m expiries.

Since the slumps are likely in near term and upswings in consolidation phase seem to be dubious as per the signals generated by technicals as well as from IV skews, AUDJPY option strips strategy should take care of both upswings and downswings simultaneously, even if the RBA surprises with the forecasters and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on downside.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed