In many respects, we feel EM Asia FX is stuck between a rock and a hard place as we enter 2020. The bullish scenario is one in which we see a Phase I US-China trade deal, which drives USDCNH back below 7.00 and boosts sentiment, whilst the cumulative action of the G2 central banks aids a capex rebound and drives a turnaround in external demand for the region. However, our economists only expect a bounded lift in global capex, as we are late in the cycle and supply chains within the region have already started to shift.

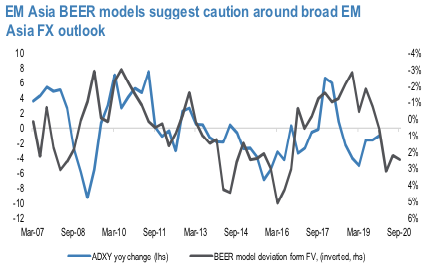

Moreover, current levels of the ADXY are already consistent with EM Asia export growth returning to positive territory. Hence, some ‘good news’ is already priced in. This viewpoint is supported by our BEER model metrics, which suggest EM Asia FX sits slightly on the expensive side. This leaves us trading with a tactical rather than strategic bias. We look for CNH strength in Q1, so we take off our USDCNH call but maintain spreads and the EURCNH strangle. USDINR looks good risk/reward via options at current levels, particularly as seasonals are favorable.

The bullish scenario is one in which we see Phase I US-China trade deal, which drives USDCNH back below 7.00 and boosts sentiment, whilst the cumulative action of the G2 central banks aids a capex rebound and drives a turnaround in external demand for the region.

However, our economists only expect a bounded lift in global capex, as we are late in the cycle and supply chains within the region have already started to shift. Moreover, current levels of the ADXY are already consistent with EM Asia export growth returning to positive territory. Hence, some ‘good news’ is already priced in. This viewpoint is supported by our BEER model metrics, which suggest EM Asia FX sits slightly on the expensive side. If we push forward this valuation gap from the BEER models by 12 months it does a reasonable job of lining up with the turning points of the ADXY (refer above chart).

Equally, though, reduced tail risks for a sharp CNY depreciation, coupled with the prospect of sequential improvement in data momentum, leaves it difficult to position aggressively for Asian FX weakness. The EM Asia FRI feel sharply between mid-May to early October but has stabilized in the last 2 months and nudged higher.

On this basis, the recommendations are generally tactical rather than strategic. We maintain a short EURCNH 2M 7.55-7.90 strangle, as an expression of the range bound CNH outlook. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts