Palladium has crossed the $1000 per ounce barrier for the first time since 2001, driven by a lower supply of the material and increasing demand from car manufacturers. The price of Palladium also crossed that of the Platinum last month, for the first time in 16 years as the demand for Platinum, which is largely used in Diesel engine cars faded after a crackdown on diesel cars by governments around the world.

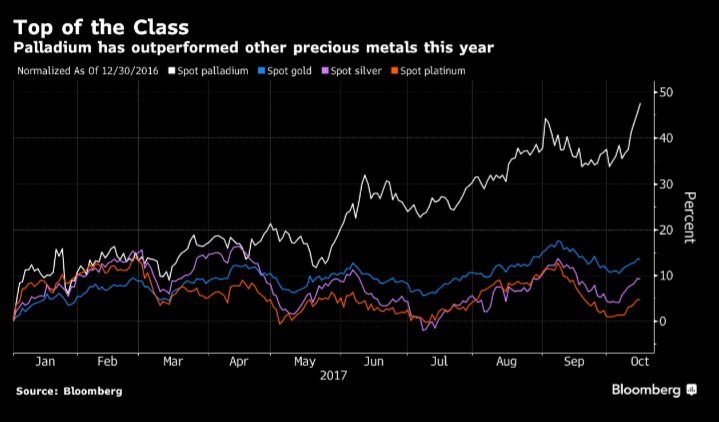

The chart from Bloomberg show Palladium has so far outperformed other precious metal as the price is being driven by fundamentals. While Silver and Platinum has so far returned less than 10 percent and gold less than 15 percent, Palladium has returned close to 50 percent.

Russia and South Africa are the two major Palladium producing countries. They together control more than 80 percent of global supplies.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX