The high uncertainty about the political future of Brazil is not putting pressure on BRL at present. The generally positive market sentiment as well as the credible monetary policy support BRL. If these framework conditions were to change BRL might come under pressure in the run-up to the elections. We expect a continuation of the sideways move in USDBRL for now, but in our view, the risk is clearly pointing to the upside.

It is difficult to predict the outcome of the Presidential elections in October at the moment. The former President Luiz Inácio Lula da Silva has a clear lead in the opinion polls. However, the problem is: he was convicted of corruption last year. On Monday the second application for appeal was rejected. He can still take his appeal further, but the likelihood of him standing in the elections in October seems slim. It is difficult to comment on the rest of the candidates. It is possible that Minister of Finance Henrique Meirelles might stand as a candidate, he will take a decision next week. Moreover, there were reports that the acting President Michel Temer is considering a further term in office.

Along with the above-discussed EUR/EM constructs that take advantage of high carry-to-vol, with the Fed in a slower gear than the markets expected here we widen the net by employing no-touch structures as a passive play on limited upside in high beta FX.

No-touches can be seen as defined downside alternatives to selling naked vanilla high-beta & EM puts and are well suited to take advantage of a modestly risk-positive environment that should emerge after the trade dust settles.

The 1st chart ranks 3M high beta structures with barriers set to 1-sigma away from the spot (arbitrary condition but sets pricing of different pairs on similar footing and strikes us as a sensible barrier selection).

No-touches take advantage of elevated fwd points, vols and skew. Effectively vol selling structures, no-touches are inherently low leverage trades, as is the case for other income harvesting strategies (e.g.vol, carry and vanilla selling).

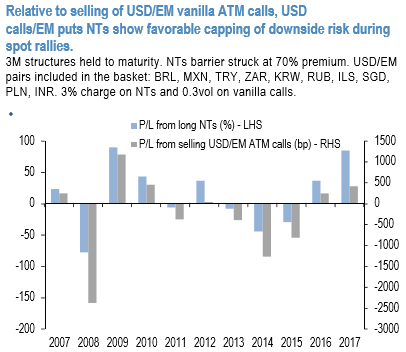

The 2nd chart demonstrates back-testing buying of no-touches relative to selling vanilla USD calls/EM puts for a basket of 10 USD/EM pairs and outlines the capped downside advantage of NTs during the dollar rallies, that makes NT performance d risk-reward characteristics favorable. Courtesy: JPM

Given the analysts’ constructive view on USDBRL and USDRUB and favorable pricing consider:

Buy 3M USDBRL call no-touch with barrier @3.400, the level not breached since Dec 2016, costs 39.5% USD.

Buy 3M USDRUB call no-touch with barrier @59.00, the level not breached since last Dec, costs 45% USD.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate