This is just a review of the short put ladder option strategy that was advocated on exactly a week ago (14th June).

Before we begin please follow below weblink for our previous option recommendation on this pair:

The updates on OTC EURJPY are as follows:

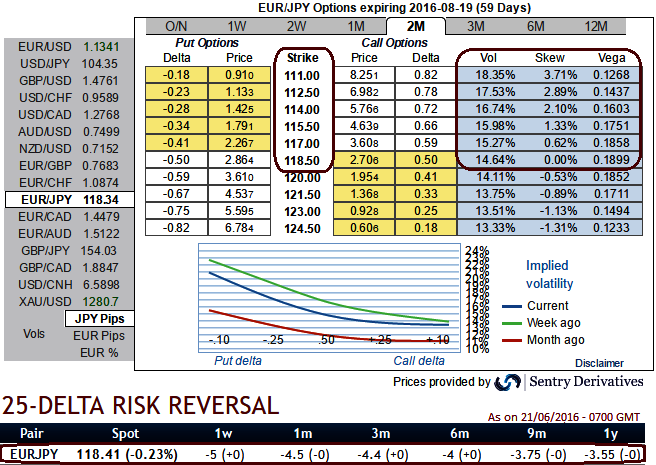

The current IVs of ATM contracts are at 16.55% and likely to spike higher levels above 27% in 1w and 2w tenors ahead of UK referendum this week, it is likely to perceive at 16% thereafter during 1m tenors.

While delta risks reversals have bearish-neutral right from 1w to 1y tenors that mean overall hedging sentiments favor bearish risks even though there are positive flashes. So, one can expect abrupt upswings in between the long lasting downtrend.

Eyeing cautiously on any abrupt upswings in EURJPY and spiking IVs would be conducive for option writers, shorts have been favored by acknowledging the implied volatility spiking when positive flashes keep popping up (see IV nutshell on every positive flashes of risk reversals).

Thus, please be noted that the shorts of 1w expiries are performing better so far.

2 lots of longs of 2m tenors would take care of downside risks signaled by the negative risk reversals of EURJPY in a long run during significant Brexit risky event.

As the delta risk reversals have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in both short and long term, it encompasses many risky events in both short and long run that could pose potential headwinds for sides of this pair.

As stated in our earlier call, the risky event (Brexit event) could hamper euro’s prospects. Given concerns over limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for long term hedging.

For now, stay firm with longs in ATM puts with 2m tenors as EURJPY is forecasted to retest 3 and a half year lows of 115.497 levels.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One