BoE is scheduled for its monetary policy on 2nd August; the MPC is expected to raise interest rates by 25 bps to 0.75% at its August policy meeting.

While the majority of the Committee are expected to support the move, some dissent also seems likely. Internal members Jon Cunliffe and Dave Ramsden remain the most likely candidates to vote against an increase.

UK GDP growth and inflation projections are likely to be little changed. However, risks remain skewed towards modest growth.

BoE’s guidance of the real rate of interest to focus attention on a 2.0 – 2.5% medium-term bank rate.

The joy that the Brexit negotiations on the British side are no longer being led by a Brexit extremist is justified. But the recent comments by EU negotiator Michel Barnier quickly dampened exaggerated euphoria in the currency market. He pointed to all the imaginary buildings in the British Brexit paper, such as the conceptually non-existent technical solutions for customs clearance that the British White Paper dreams of.

We reckon that the sterling should not suffer in the near-run. The interest rate hiking cycle by the Bank of England next week is now the consensus opinion in the market, but, one should not disregard the Fed on the other hand. Likewise, the primary disparity between BoE interest rate policy and ECB interest rate policy is strengthened and made clearer. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

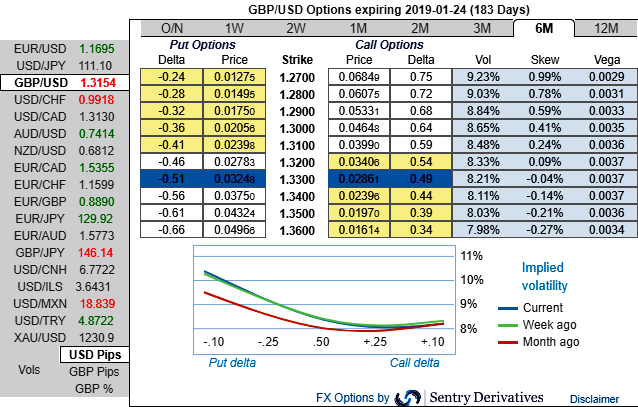

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (3m IVs) and 6m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 3m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 6m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in long run by delta longs.

The political and economic backdrop remains supportive of sterling’s underperformance. We continue to be short but take partial profits by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 31 levels (which is bullish), while hourly USD spot index has bearish index is creeping at 2 while articulating (at 15:28 GMT). For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady