Recently, the Russian central bank (CBR) announced that it was officially suspending FX purchases on behalf of the finance ministry until the end of this year; it added that it may resume FX purchases in 2019 but the issue was open. CBR deputy governor Ksenia Yudaeva summarised a few other points – for example, that CBR sees 6%-7% as the equilibrium interest rate for Russia medium-term, but considers the current 7.5% as neutral because of elevated risk premium from sanctions.

RUB seems undervalued and the suspension of the FX purchases on behalf of the budget rule could lead to a convergence to fair value. The budget rule has proved extremely effective in decreasing RUB’s beta to oil and complicates fair value assessments which rely on historical regressions.

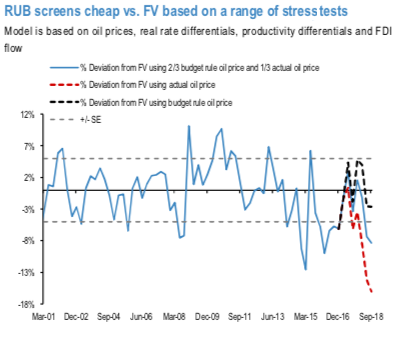

In our preferred methodology, our BEER FV model relies on a weighted average between the current oil price (1/3 weight) and the budget oil price (2/3 weight; $42.8pb Brent). This is most consistent with the “theoretical impact” of the budget rule, in our view. Such an adjustment to the model leaves RUB currently 8.3% cheap to FV.

However, with the CBR extending the pause in its FX reserve accumulation program until year-end, oil could have a more pronounced impact on RUB in line with historical betas. Relying on actual oil prices (with no budget rule adjustment), would show RUB as substantially undervalued, by around 16% (refer above chart).

Importantly, the full current account surplus (6.6% of GDP in Q2 2018) can now directly support the currency. We estimate CBR will over the full period of the suspension forgo about $27bn of FX purchases. However, considering substantial and unpredictable geopolitical risks, we would recommend to rely exclusively on option exposure for RUB appreciation plays.

Buy 3M USDCAD 25D call vs sell USDRUB 25D call, in 1.8:1 vega. Oil hedged EM – DM vol compression RV with NAFTA edge.

At spot reference: 66.595 levels, 06-Nov-18 USDRUB 1x1 put spread (69.36/64.14) is advocated. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 83 levels (which is bullish), while articulating (at 13:44 GMT). For more details on the index, please refer below weblink:

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data