Today, euro-focused views are visible in the markets as the series of data announcements are lined-up, with the highlight being the ECB policy announcement at 12:45BST and press conference starting at 13:30BST. During the morning, Eurozone GDP and CPI inflation figures, as well as German unemployment claims, will be released. After that, US weekly jobless claims, along with March personal spending and the PCE deflator, are also due.

Following the French numbers, there are downside risks to Eurozone Q1 GDP forecasts. We had pencilled in a 3.0%q/q contraction (consensus: ‑3.8%), but any number in any case is likely to be dwarfed by Q2. We also predict Eurozone ‘flash’ April CPI to decline to only 0.2%y/y (consensus: 0.1%) from 0.7% in March. The economic shutdown is also expected to lead to a sharp rise in German jobless claims to around 40k in our view, but the risk is that it may be higher.

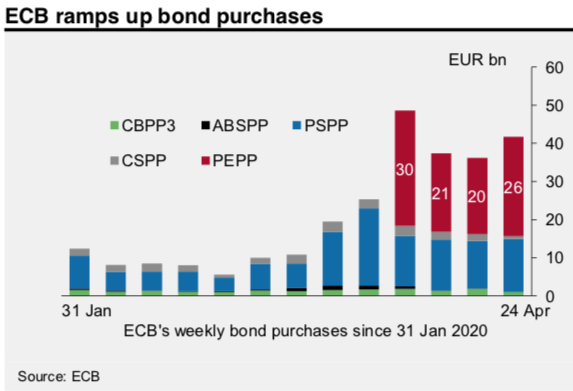

The main event is the ECB policy decision. Interest rates are expected to be left unchanged, while the ECB has already committed to buying €1.1 trillion of bonds this year, including €750bn in the new Pandemic Emergency Purchase Programme (PEPP) covering both public and private sector securities. Nearly €100bn of bonds under the PEPP has been bought in the past four weeks (refer 1st exhibit).

The ECB has stated that it is “fully prepared to increase the size of its asset purchase programmes and adjust their composition, by as much as necessary and for as long as needed”. That points to a risk that the PEPP may be expanded today, but it’s probably more likely the ECB hold off for now while sending a strong signal of its readiness to do more in the future, especially if economic prospects worsen further.

Elsewhere, RBA is scheduled for their monetary policy for the next week, in many respects, AUD’s performance over the last month played to script. Rising volatility across equity markets (refer 2nd exhibit) and sharp downward revisions to global growth accelerated downside for Aussie pairs, although we note that AUD does look elevated given the extent of downward revisions to the latter. We have written before that AUD’s seeming insensitivity to global cyclical dynamics prior to COVID-19 had less to do with a structural change in the currency's inherent drivers and more to do with the unusual characteristics of the global backdrop (specifically, low vol, short-lived equity market drawdowns etc.)

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched towards OTM calls, the positively skewed IVs of 3m tenors are signifying more hedging interests in bullish risks (refer 3rd exhibit). More bids for OTM call strikes of 1.76 levels of this tenor.

Contemplating fundamental and OTC factors as explained above, although it is sensed that all chances of Aussie dollar looking superior over Euro in the near term and vice versa in the medium-term future; we advise to hedge the puzzling swings through below options recommendations.

The execution: Spot reference: 1.6635 levels, buy 2 lots of at the money 0.51 delta call option of 3m tenor and simultaneously, buy at the money put option of 1m tenors. The option strap is more customized version of straddles but instruments slightly biased bullish risks. Courtesy: Sentry, JPM & Lloyds

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook