The Reserve Bank of Australia (RBA) made a strong effort over the past year to prevent a strong appreciation of the AUD against the USD. But through 2018, it is likely to be somewhat more open to an appreciation of the AUD.

But on the one hand, the US Federal Reserve would support the USD with further interest rate hikes, which should limit the upside potential in AUDUSD anyway. The Australian economy and inflation are likely to develop in the direction it desires so that the RBA can also slowly aim to normalize its monetary policy.

While most importantly, Australia reported a trade deficit of AUD 0.63 billion in November of 2017, an increase of 108 pct from a downwardly revised AUD 0.30 billion gap in the prior month and missing market expectations of an AUD 0.55 billion surplus.

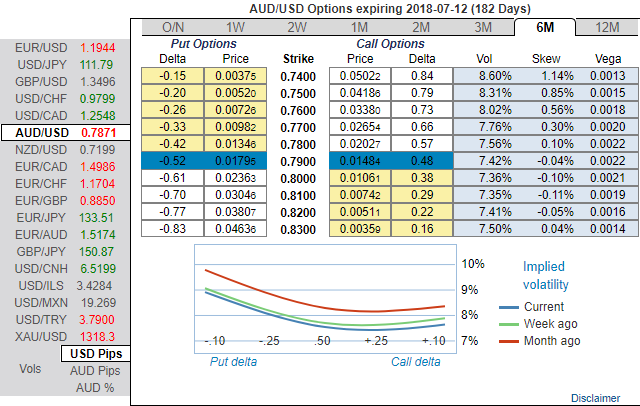

Please be noted that the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.74 levels (above nutshell). Bearish neutral delta risk reversal also indicates that the hedging activities for the downside risks remain intact.

Noticeably, ATM IVs of 6m expiries are above 8.5%, while 1m IVs are just shy above 6.6%. Hence, the rising IVs in 6m tenors and stagnant IVs and bearish neutral RRs in 1m tenors are deemed as the right combination to hold ATM longs and ITM shorts in diagonal put ratio back spreads (PRBS).

Accordingly, put ratio back spreads a couple of days ago were advocated, short leg, for now, is functioning as the underlying spot FX keeps spiking, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 6m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) ITM put option (position seems good even if the underlying spot go either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 6m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data