On the back dollar strength, gold futures were down 1.07% at $1,341.7 a troy ounce by 02:00 a.m. ET.

Gold vols skews should stay well supported and have room to widen striking 3M delta-hedged 25 delta riskies as a good value, positive vol carry risk off hedge.

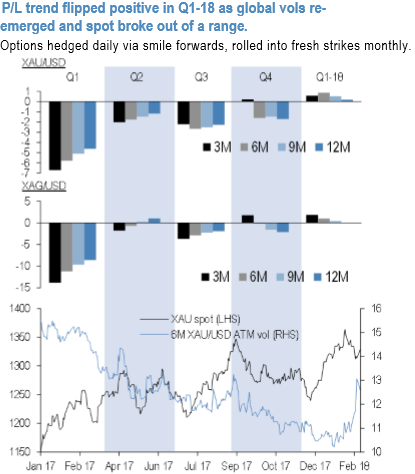

Coming off a downbeat 2017, precious metals long vol trades started to make money in Q1 2018 (refer above chart). Safe haven assets vols were sharply higher on the back of the recent global vols rally that got an additional kicker from the full-blown equity markets panic that followed the Feb 2 hourly earnings print. Between the strong US CPI print and disappointing retail sales last Wednesday the markets seems to be getting a cue that the panic is over

Front-end Precious metals vols rebounded, at last. With a number of upcoming catalysts bound to keep realized vol tactically firm, XAGUSD strikes us as a solid defensive gamma hedge especially when paired in an RV with AUD in a delta-hedged XAG –AUD 25D put spread.

Buy 3M XAGUSD @ 18.6/19.25 vol vs sell AUDUSD @ 9.9 vol indicative 25 delta puts, in vega neutral notionals.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 139 levels (which is highly bullish) while articulating (at 08:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025