The MXN is likely the most vulnerable currency to changes in the global trade value chains, in particular, if a protectionist wave comes from the US.

The currencies with direct exposure to the US market via exports, or even economies with trade openness above average, are set to underperform in the run-up to the election if polls suggest a tight race. Mexico’s exposure tops the charts with around 81% of its exports going to the US.

On the geopolitical front, the US election cycle proves significant event risk for currencies like MXN, with a more protectionist flavor gaining relevance. The US election polls shift against Trump, sell MXN vol US election risks shifted meaningfully over the past week as the Trump campaign stuttered.

One of the exit poll watchers now has the probability of a Trump victory pegged at only 14% after the latest series of polls, while betting markets (predictwise) have swung to an even more extreme 90-10 split in favor of Clinton.

With perceptions of greater assurance around the outcome, implied trade tension and uncertainty premiums have narrowed, especially in MXN, JPY, CHF, and the broad dollar overall (Modest reduction in election risk premiums as Clinton probabilities make new highs).

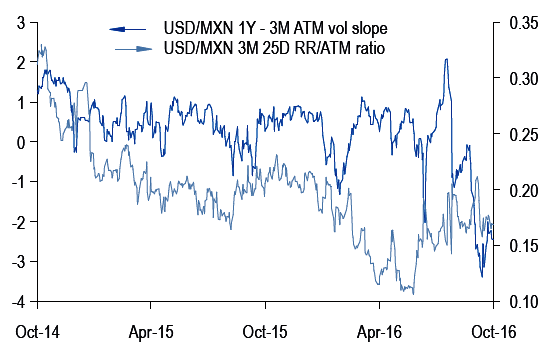

USDMXN vols have now subsided appreciably from their highs (3M ATM -3.5 vol pts. from pre-presidential debates peak), but even so, their decline has lagged Donald Trump’s dwindling poll numbers.

From the above chart, it is understood that the frontend options MXN vol shorts are better instituted in shorter-tenors given the extreme inversion of the vol surface, and via USD puts/MXN calls since risk-reversal / ATM ratios are still low (see above chart).

In terms of strikes, we favor selling USD puts/MXN calls that are somewhat rich on the surface given historically low-risk reversal / ATM vol ratios and pack in a comfortable 1.5 vols of the premium over recent RVs.

By virtue of their long risk-reversal orientation, selling low strikes has the happy benefit of drifting towards peak vega as USDMXN slides further in the event of a Clinton victory and losing convexity if USDMXN were to spike sharply in the event of a shock Trump win.

We advocate 2M 35D USD puts/MXN calls in our portfolio this week. There will be some unavoidable gamma pain for shorts though if USDMXN falls sharply after the elections, the risk of which can be managed by buying narrowed-expiry (preferably 1w) USD puts/MXN calls closer to the Election Day.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data