The focus in the euro area today will be the account from the ECB’s June Governing Council meeting which will be analyzed for any further insight into the likely timing of the ECB’s announcement of a gradual tapering. Data-wise, ahead of tomorrow’s release of the latest industrial production figures, this morning’s German factory orders figures showed a 1%M/M rise in May after a fall of more than 2.0%M/M in the previous month. Given the strength of business sentiment surveys – for example, this week’s manufacturing PMI was at the highest level in more than six years – the figures seem to be on a soft side, in particular given that domestic orders declined for the third consecutive month, this time by almost 2.0%M/M.

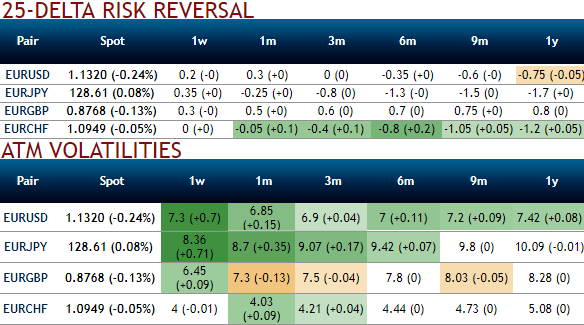

Please be noted that the nutshell showing implied vols and risk reversals of euro crosses indicate gaining hedging traction.

As per JPM's analysis, EURUSD vs EUR-cross option RVs are tenable only if the short leg is restricted to a handful of intra-European crosses such as SEK, NOK, PLN, HUF and CHF that are able to buck the Euro bull trend (refer above chart).

The long 2M25D EUR call/USD put vs. short 2M 25DEUR call/PLN put switch that we initiated last week as a long USD-correlation play also satisfies this requirement, and has worked out well amid the sharp Euro spike.

This resembles as a delta-hedged version, but the spread works just as well on a non-delta-hedged basis as an RV expression of Euro bullishness. One could also consider variants such as selling EURPLN strangles instead of just EUR calls to take advantage of the tension between rich zloty valuations on the one hand and continued strong capital inflows that could trap the cross in a range.

On the whole, this family of RVs appeals to us as a way of participating in the Euro trend with in-built long USD-correlation exposure (and hence some protection against equity market jitters), so we extend the search for similar candidates by including all USD pairs of Euro-proxies on the long side (CHF, PLN, HUF, NOK, SEK) and their EUR-crosses on the short side.

The chart above explains that EURUSD – EURSEK, USDNOK – EURNOK, and EURUSD – EURPLN are the three best vol spreads to own on usual implied vs. realized vol grounds. We already own two of these (SEK, PLN), but prefer taking profits on the SEK version given the risk of idiosyncratic krona moves following next week’s Riksbank meeting and substituting it with NOK; we enter USDNOK – EURNOK 100:120 vega-weighted 2M straddle spreads.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different