Although GBPUSD has managed to bounce, the British currency has been tumbling massively and long term trend still seems intact as the “YouGov” poll found 45% favoured the UK leaving the EU, with 41% wanting to stay, while a separate Observer/Opinium poll also found the Leave campaign ahead by 43% to 40%.

Heightened BoE policy uncertainty ahead of Brexit polls:

- The rational response to the risky uncertain event is to defer the strategic investments and hiring decisions.

- BoE’s monetary policy uncertainty to remain a headwind on the case that Britton exits from euro group in conjunction with global economic turbulence in both 2016 and 2017.

- The risks are biased to the downside in the event a political event delivers an adverse outcome.

- On a broader perspective, sterling against the dollar has dropped more than 8.44% from last one year, GBPJPY slumped by 19.74% in one year, while EURGBP gained by 0.6930 in the same span.

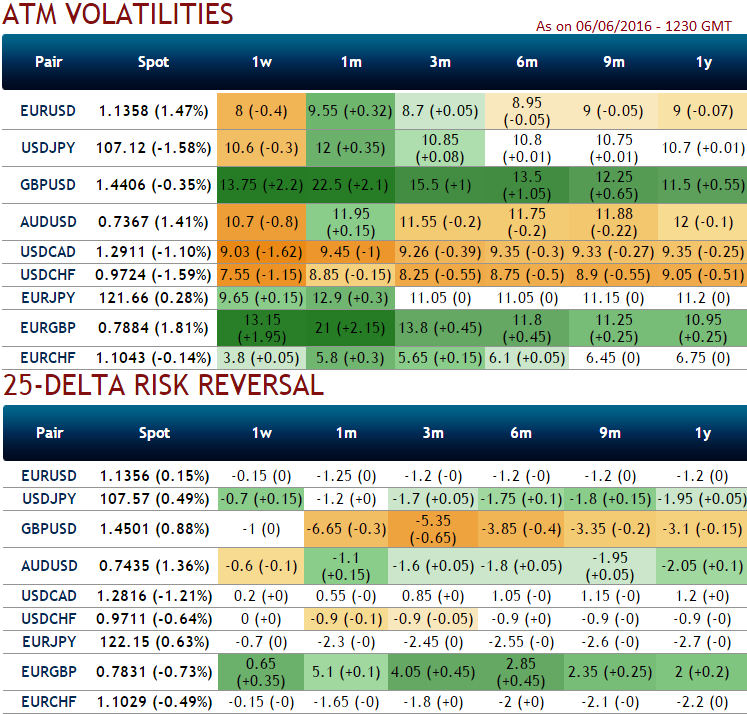

The FX option activities of GBP crosses have been intensified, ATM GBPUSD IVs of 1m tenor have spiked above 22% with rising negative hedging sentiments. While euro’s gains against sterling are suggested by positive risk reversals.

Long options spreads are the long call or long put spreads (long the spread, not the underlying instrument, so one can be long a GBPUSD put spread) in which the trader buys an option and sells an option of the same amount for the same instrument and expiry.

But one that is deeper out of the money. (For example, long a 0.7800 EURGBP call and short a 0.8000 EURGBP call).

Why do you have to do so: Since the speculator has placed both buying and selling option position, it radically reduces the cost required for a payout at a given price on expiry of the option for more modest market moves, especially as deeper out of the money options assume higher volatility which is there in OTC FX as you can observe IV nutshell for GBP crosses for 1-3m tenors (they are the highest among G10 space).

The maximum payout is limited if the price moves very far and hedging judgment or trading out of the option structure can end up with more challenging scenario in a rebellious market as the trader is both long and short an option (especially if close to expiry and the sold option is not in the money or near the strike price and thus retaining considerable premium relative to the deep in the money long option).

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX