Briefing on technical analysis: The minor trend of cable (GBPUSD) formed rising channel and in the recent past it has broken out rising channel resistance but couldn’t sustain. As a result, failure swings have dragged the slumps below EMAs (refer weekly chart). The general setup of the British Pound remains fragile, which is best illustrated in Cable, where the double failure to beak or stabilize above 1.4342 (int. 50 %) in January and mid-April already led into a key-reversal week down as displayed last week. That said, we are now looking for a minimum setback towards 1.3450 areas.

Let’s glance at GBPUSD sensitivity tool, the positively skewed IVs of 3m tenors are signaling the hedging interests in the bearish risks, 3m bids are upto 1.32 levels. As a result, OTM puts strikes likely to expiring in-the-money.

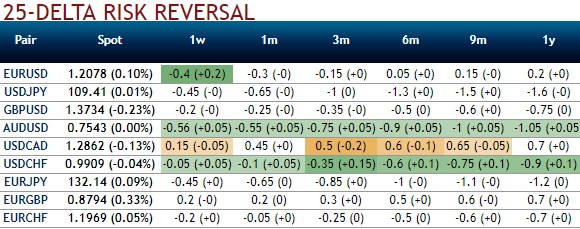

While there no shift in risks reversals (refer 1m RRs – bearish neutral) that indicates the bearish risks remain intact in the underlying spot FX prices in near-terms which is in tandem with the technical analysis but bearish sentiments are mounting in medium-term basis (3m tenors).

The bearish risks in longer tenors also remain intact as the negative risk reversals of longer tenors indicate hedgers still bid for downside risks. ATM IVs are trending between 7.9% - 8.7% ranges for 1-2M tenors.

Hence, in order to arrest downside risk that is lingering in both short-term trend and major declining trend, we recommend restructuring previously advocated options straps into the diagonal option strips strategy that favors underlying spot’s downside bias in the short-run and mitigates bearish risks in the medium-term.

Hence, we advocate building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta puts and 1 lot of ATM -0.49 delta calls of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bearish as well as bullish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether the underlying spot keeps flying or dipping.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -158 levels (which is highly bearish). Hourly USD spot index was at shy above 131 (bullish) while articulating (at 12:52 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings