This pair has been oscillating between 76.739 and 76.065 levels, showing mild upswings but long term declining trend seems to be intact as you can see the convincing volumes and technical indicators favouring bears on the monthly charts.

While IVs of ATM contracts of 1w and 1m tenors are spiking crazily at shy above 11 and a tad below 15% respectively, this has been justified by historical volatilities in spot FX fluctuations (see big real body candles on monthly technical charts).

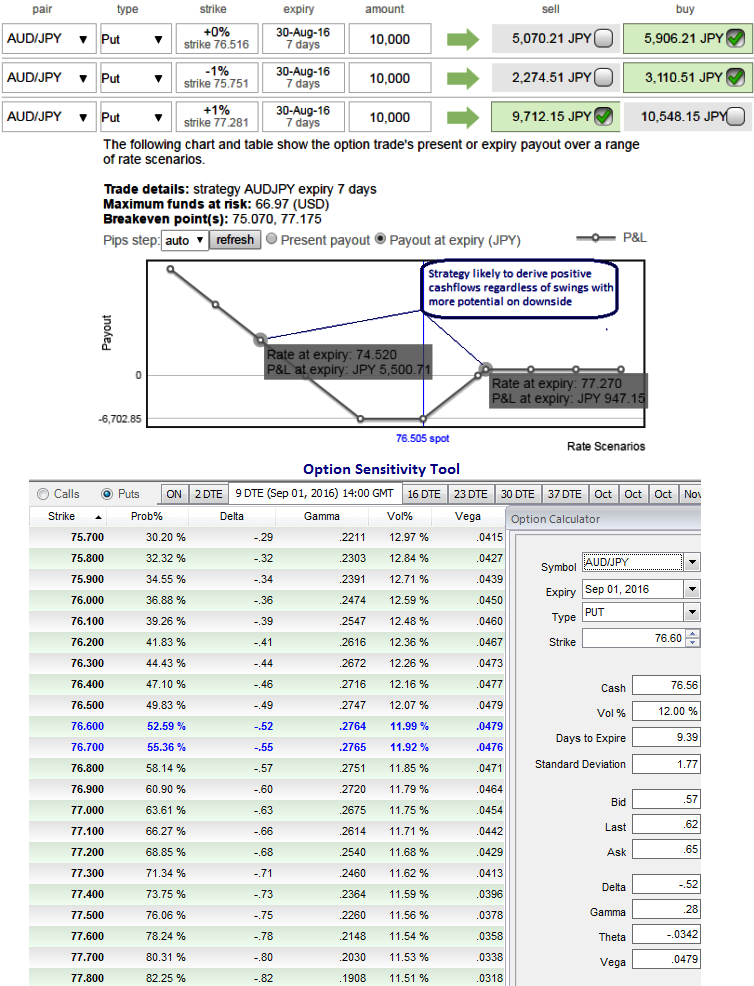

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 16% and it is quite higher side when long-term trend is bearish and spikes in previous rallies for the short term which is good sign for option writers.

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

Since the spot Fx of underlying pair is rising along with IVs, this is good news for option writers as such options with a higher IV costs more. Thereby, writers are likely to receive more premiums.

Well, on the contrary, if the same IV during longer tenors keep increasing and you are holding an option, this is good for holders as well. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 1 lot of at the money -0.51 delta put, 2M 1 lot of (1%) out of the money -0.35 delta put and sell 2W one lot of (1%) In-The-Money put option.

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022